Clearly, this is a competitive industry to break into and for good reason. Few other jobs offer such a combination of stellar compensation, high quality work experience and exit options that are worth their weight in gold. However, it also makes high finance a hard nut to crack, and you need some sort of an edge to get in.

Special Offer for BankersByDay: Get 15% off on Wall Street Prep courses!

Click here and use code BANKERSTraining providers like Wall Street Prep (WSP) have been training investment bankers for decades now and giving them this edge. I myself went through some of their course material over 13 years ago when I was in business school. Recently, I got the chance to go through their course material once again and here’s my comprehensive review of Wall Street Prep’s Premium Package and other courses.

The Inside Edge

Learning the basics of finance isn’t all that hard. Most of us will learn it in business school at some point, and some even self-learn with a good book or three. But the truth is that the basics won’t get you far. You have to be exceptional.

Finance is an industry with a lot of jargon, a lot of special cases that require special treatment, a lot of assumptions and a lot of nuances that only industry practitioners know. As much as I love books, you really won’t find it all there. That is where I think Wall Street Prep really excels. It’s a course made by industry practitioners for industry practitioners. It’s not an academic course that focuses only on the theory. The idea here is to have you hit the ground running on Day 1 of your job or internship. Isn’t that what recruiters are looking for?

That is why I can truly appreciate WSP’s rare combination of knowledge and the ability to effectively communicate that knowledge to others with such elegance.

I have interviewed dozens people for various finance and fintech roles over my career. Since I am well aware how gruelling this process can be, I try to be as friendly and understanding as possible. I don’t hold it against someone if they don’t know something that only a person with years of experience would know. But what I was witnessing was that fresh graduates are now armed with knowledge that I expect only industry practitioners to know. And its courses like WSP Premium that is arming them with this knowledge. That is your inside edge. The coup de grâce to help you nail that final interview.

Its impressive to see and frankly, it also makes the hiring decision that much easier.

Course Material

Wall Street Prep is hired by some of the world’s top investment banks and private equity firms to deliver training to their employees. Firms like Goldman Sachs, Evercore, Morgan Stanley, Lazard, JP Morgan, Moelis, KKR, Bain Capital, The Carlyle Group and so on. As you can imagine, these companies expect nothing but the very best.

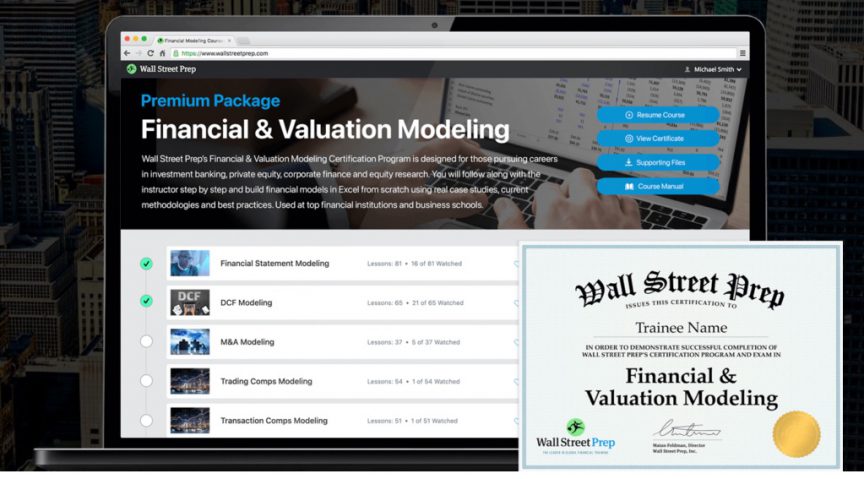

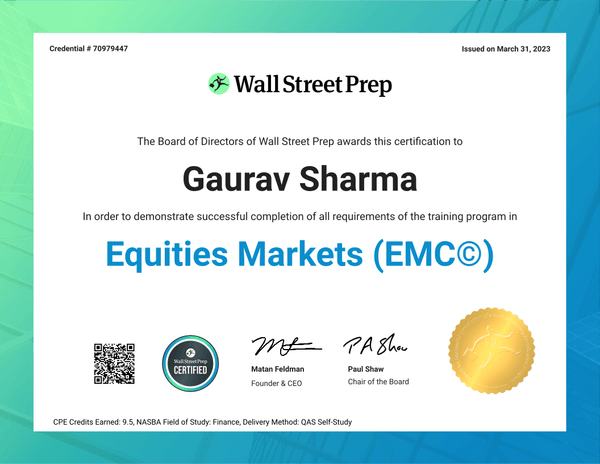

You get a nice certificate that you can embed to your LinkedIn profile or anywhere else

WSP’s course material is designed with such standards in mind, and it clearly shows. I have undertaken a lot of trainings and corporate workshops and WSP is right up there in terms of quality of instruction and the course material.

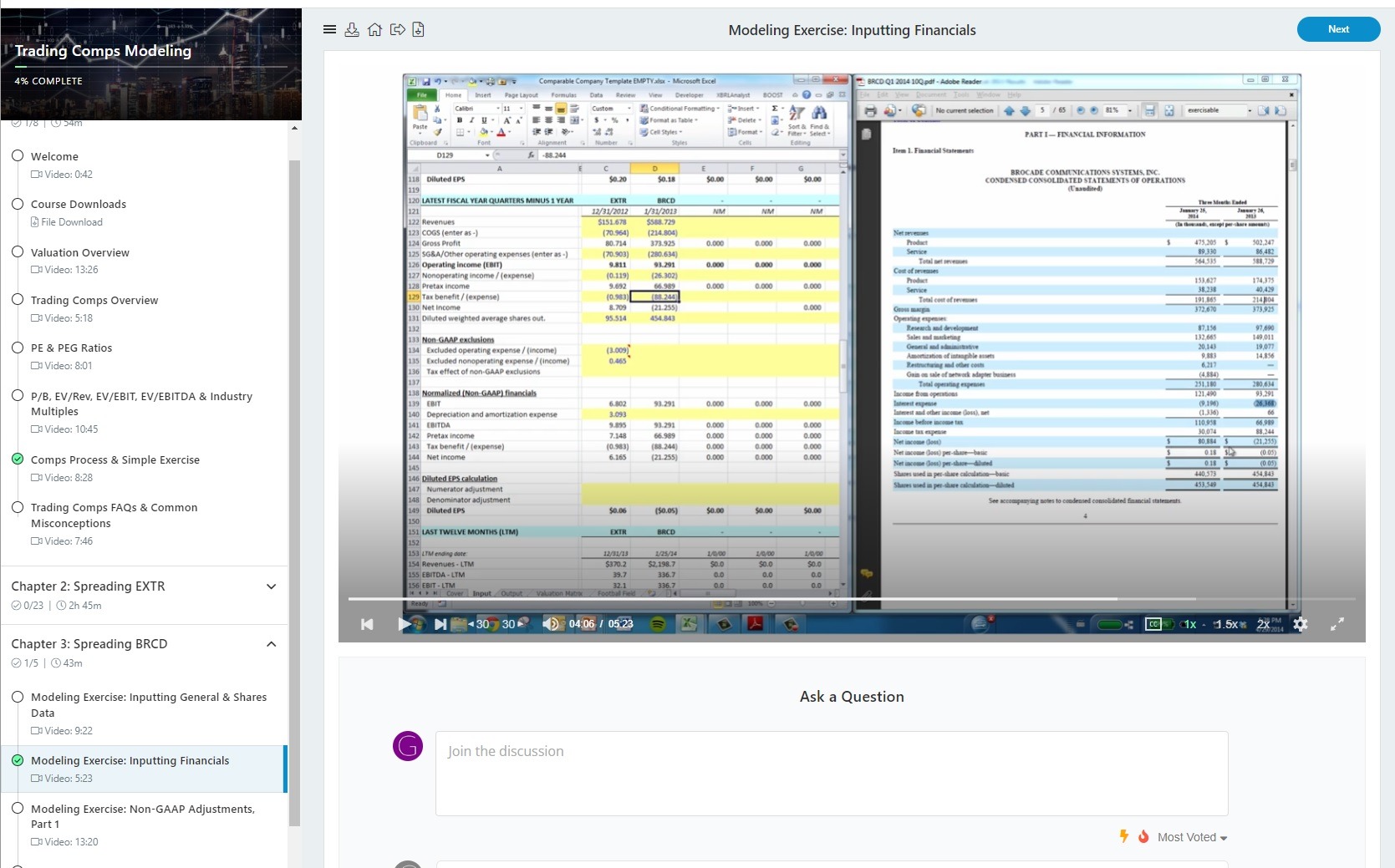

My favourite learning tool is case studies. And there are a lot of case studies here for you to sink your teeth into. I may have forgotten some of the theory I studied 15 years ago, but I still remember most of the case studies. That’s just how the human brain works so it’s good to see that learning style being realized here.

The instructors are industry insiders, and I am personally impressed with how they have managed to keep all the content engaging and relevant. Most people that I work with in finance are pretty smart, but they are not very good at explaining things. And the ones who are good at explaining things are running the place so they don’t have time to teach! That is why I can truly appreciate WSP’s rare combination of knowledge and the ability to effectively communicate that knowledge to others with such elegance.

Learning Support

Wall Street Prep offers some unique features that make it stand out when it comes to leaning support. My personal favourite is the comment section underneath each lesson where users can ask questions and they actually get answered!

If you have a question, its highly likely someone else already had the same question sometime in the past and it’s probably been answered. You can just scroll down and find your answer in most cases. If you don’t find it, you can just ask your question and it usually gets answered very quickly. Its an active comment section that is not only helpful for answering your questions, but it also helps you pick up on things that you missed. Essentially, its like providing the benefits of a groups study session without nay of the downsides.

The support team will also try and help you out with questions not related to the course material. For example, you might have some questions about your career, or resume and cover letter and you can get these addressed.

Brand Value

Personal branding is by far one of the most important factors in your career success. Of course, you have to be good at your job but first you actually need to get that job! That is where personal branding comes in and this is another strong point of WSP.

WSP has been around for decades now and they have built up strong brand recognition in the industry. WSP trains bankers at some of the world’s top financial institutions, investment banks, private equity firms and even regulators which has allowed them to build up a big alumni network. If you are interviewing for a finance role, especially in IB or PE, its more than likely your interviewer has heard of WSP.

WSP alumni work at firms like Goldman Sachs, Evercore, Morgan Stanley, Lazard, JP Morgan, Moelis, KKR, Bain Capital, The Carlyle Group etc. Since a lot of these top investment banks hire WSP to train their employees, the brand recognition is instant.

Special Offer for BankersByDay: Get 15% off on Wall Street Prep courses!

Click here and use code BANKERS

Skill level & Pre-requisites

These are advanced courses meant for serious investment banking applicants and industry professionals. That is a good thing because the industry you are trying to break into isn’t really known for being easy. You are competing with some of the smartest and most ambitious people on the planet and this course reflects that competitive spirit and matches it in every aspect.

You are competing with some of the smartest and most ambitious people on the planet and this course reflects that competitive spirit and matches it in every aspect.

That does not mean that the material is hard to follow. The instructors ensure that everything is legible and palatable in bite-sized chunks. The video lessons are easy to follow, and everything is explained in adequate detail. It’s just that this course is for serious candidates who are willing to put in the effort to make their dreams come true. And that my dudes and dudettes, requires grit, determination, and ambition.

If you are thinking of a career in finance, then math, logical reasoning and Excel are mandatory skills. You don’t need to know advanced statistics, but I assume you are familiar with the basics. There are accounting and Excel crash courses on offer for those who need it.

Wall Street Prep Premium vs Basic package, which one to choose?

Premium Package – This is the one I would recommend to most users. This is the exact same program that they teach at investment banks to train their banking professionals. It covers financial modelling, DCF, training and transactions comps, M&A and LBO.

Basic Package – This is essentially an abridged version of the Premium Package that contains only the financial modelling section without the other parts. So, if you just need that, this might be a more cost-effective option.

Other advanced courses

These are courses for very specific roles. For example, if you know you are applying/ switching to Project Finance or Commercial Real Estate or the Fixed Income Group etc., then these courses dive deeper into those specific topics.

- Private Equity Masterclass – For private equity professionals, bankers or MBA students looking to break into PE. You will learn about the deal process and LBO modelling.

- The Ultimate Project Finance Modeling Package – If you are applying to a Project Finance Role, then this one is a more deep dive into the topic.

- Financial Planning & Analysis Modeling Certification (FPAMC©) – This is for Financial Planning and Analysis professionals. A decent package that aims to bridge the gap between theory and practice.

- Fixed Income Markets Certification (FIMC©) – Fixed Income has always been one of my favourite topics and this course does not disappoint. If you are looking at DCM, FICC or anything related to fixed income markets as a career choice, this is a great pick!

- Real Estate Financial Modelling – Ideal for CRE professionals or anyone looking to get into Real Estate modelling.

- Project Finance – A comprehensive course for Project Finance professionals which offers role specific modeling training.

Introductory Crash Courses

- Accounting Crash Course – This is a basic introductory course to accounting that you may want to take if you are unfamiliar with basic accounting. Its mostly meant to be a prelude to one of the other courses.

- The Ultimate Excel VBA Course – Excel is a mandatory skill in finance. Take this if you are not familiar on how to use Excel for finance. In fact, it might even teach the pros a few tips and tricks to speed up your Excel magic.

Wall Street Prep Boot Camps

Wall Street Prep’s Virtual Boot Camps are essentially live virtual training sessions to help you learn finance skills. The main difference here is they these are live sessions taught by finance professionals and are offered in a highly condensed format. That second might part may be of importance to working professionals as it means that you will be going through the entire course in a matter of days. Many firms sponsor such training sessions for their employees so you might want to check if your employer has such a policy.

There are dozen of boot camp options to choose from, covering a wide variety of topics from M&A to financial modeling and even industry specific modeling like insurance, biotech, ESG, FIG etc. You can see the entire list of upcoming boot camps options here.

Will this help you achieve your career goals?

This is the question that gets asked the most and the answer depends on you really. WSP courses, like all others, are tools that you use to get you want. Eventually, its up to you to make the effort to use it correctly. It gives you the opportunity to learn from industry insiders and get access to the same program that is taught at top investment banks. That is pretty much as good as it gets. What you do with that opportunity is up to you.

Some more reviews

I messaged some of my colleagues and professional contacts who have taken a WSP course or training recently and asked them about it. Here are some of their responses:

- “It was pretty good. They kept it on point without droning on about irrelevant things. Plenty of case studies to keep you hooked.”

- “Wait, what, you are a blogger now? Who even reads blogs anymore?”

- “I really liked the presentation and focus. You know how busy I get with the kids and my existing job, but I really wanted to make a switch to finance, and this was rather helpful. It gave me the confidence to apply to every single role I could find lol. Thanks for your help too btw!”

Wall Street Prep discount code

Use the link and code below to get a 15% discount:

Special Offer for BankersByDay: Get 15% off on Wall Street Prep courses!

Click here and use code BANKERS

Conclusion

Wall Street Prep offers a unique perspective that makes you feel like an industry insider. Getting access to the same material that top investment banks use to train their hires is an incredible opportunity and gives you a definitive edge during your own selection process. Its certainly worth the asking price and, more importantly, the time that you will invest in it. Its an advanced tool for advanced users that helps you punch above your weight.