What do you get when you collide the world of traditional finance with the “move fast, break things” world of startups? Venture Capital. Even though the VC industry has been around for a while, it changes rapidly in response to trends that have not even become trends yet. We are talking about companies that are making products that you haven’t heard about yet and even startup media hasn’t got around to covering. This is literally the bleeding edge.

A lot of my colleagues and former clients think of themselves as Venture Capitalists just because they invested a few hundred grand in a startup idea that was pitched to them via a campus or Facebook group. Most of them end up burning their fingers. Because this is not supposed to be easy. Nothing worth doing is every easy. You need to know what you are getting into and you have to do the homework.

These are some of the best courses on the internet to help you learn the basic of Venture Capital. You still have to do the leg work for each individual investment, but these courses will give you the tools and help you build a framework for success.

1. The Venture Capital Associate Micro-Degree from Financial Edge

Course Review

Finding good VC courses is not easy because it’s a small and elite niche within the broader investment sector. It’s also something that requires a lot of real-world knowledge rather than drab academic theory. Because of these reasons, I was rather excited to learn that Financial Edge had launched a new VC course and wanted to check it out almost as soon as it went up. This is a top tier course provider, and their courses are always a treat for finance nerds like me.

Finding good VC courses is not easy because it’s a small and elite niche within the broader investment sector. It’s also something that requires a lot of real-world knowledge rather than drab academic theory. Because of these reasons, I was rather excited to learn that Financial Edge had launched a new VC course and wanted to check it out almost as soon as it went up. This is a top tier course provider, and their courses are always a treat for finance nerds like me.

This is a Micro-Degree course which means you will be looking at the topic in quite some detail. There are several modules most of which have been purpose built around VC specific topics. That’s a good thing because it means you won’t be wasting time reading unrelated fluff that you don’t need to. Expect the whole thing to take about 50 hours in total.

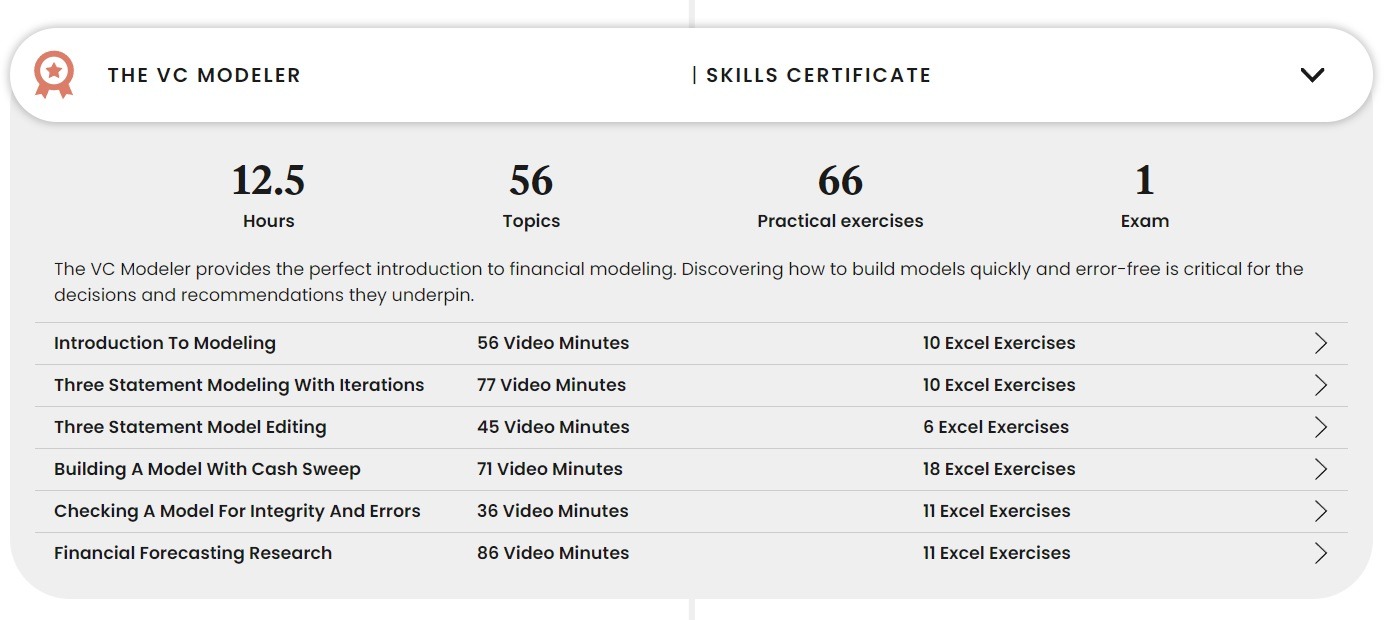

So, what is in this course? The bulk of the content is delivered via video and Excel exercises. This is exactly what you want. You can go through the videos as and when you find time and the Excel exercises are there to help hammer down the concepts and give you the confidence that you need. I am attaching a screenshot below of just a few of the modules you will be covering.

The above module focuses on how to quickly build solid VC models. Other modules focus on other relevant aspects of a VC transaction like accounting, deal making and valuation. It’s a thorough and exhaustive course and equivalent to something that a VC associate would take. Speaking of which, Financial Edge is a course provider to some of the world’s top investment banks and funds. So, you are essentially learning the same thing that hires at these top firms learn. We didn’t really have opportunities like this back in our day and if you are serious about working in finance, you must go the extra mile.

One of the things I really like about this course provider is that the presentation is really solid. It really makes taking the course a breeze and makes you want to push on. That’s a big plus in today’s world when attention spans are low. But just because the topics flow easily doesn’t mean they are not comprehensive. You really go into details and all the core topics are covered. Your instructors are all former bankers from top tier firms, so they know what’s required to break into the industry. It’s not just academic theory, its business practice and I guess that is one of the most appealing points for me.

Click here and use code BBD25 for a 25% discount on all Financial Edge courses!

Summary

| Duration | Around 50 hours |

| Format | Fully online, on-demand |

| Level | Professional |

2. Venture Finance Programme from Oxford

Who is this for?

This is the ideal course for more senior business leaders who want to focus more on strategy rather than number crunching.

Course Review

I have reviewed quite a few courses from Oxford and they have become one of my favourites. They always give you a more balanced and nuanced perspective and that feeling of accomplishment when you finish one never really goes away.

The course is made of eight modules that cover the topic pretty well and present information to you in bite-sized chunks. You’ll start off by learning about the venture finance industry, how it helps companies and how the funding cycle works. Another key area that you lean about is the types of investors in venture capital. Because each investor type has their own expectations and constraints. This could be your contacts, angel investors, crowdfunding, professional firms and so on.

Once you have got hold of those basics, you move on to the actual process of fundraising. This involves some modelling including productions, financial statements and slides showing all of this information. Valuation is a very tricky subject for startup because everything is so dynamic. Its almost as much an art as it is science and you will need to understand the key concepts of VC valuation. This topic is also covered in great detail.

From here you move slightly higher the value chain. Now, you will be dealing with the role of venture capital firms and these are run and managed, including a basic primer on what to expect as a venture capitalist. Negotiation is another area where a good venture capitalist can add the most value and it is good to see this topic getting an entire module of its own. Its definitely my favourite part as I have always been a lousy negotiator.

We close up with two module covering financial crisis and the exit plan. Exit via IPO, buyout, acquisition etc. is basically how you make money so this is your bread and butter topic.

Click here and use code GS-AF-BBD15 for a 15% discount on this course!

Summary

| Duration | 8 week with 7-10 hours a week |

| Format | Fully online, on-demand |

| Level | Executive |