Artificial Intelligence represents the next epoch in terms of technological advancement in all walks of life. Millions of applications already use AI with varying degrees of complexity to perform mundane or repetitive tasks. Banks, FinTech startups and even government regulators use AI for applications as diverse as fraud detection, investment advisory, real-time transaction monitoring, optimizing lending decisions and so on.

However, this rapid growth has created a massive shortage of talent when it comes to AI product development, coding and implementation. Firms with huge budgets are shopping around for smaller companies or developers with a proven track record in AI. And in many cases, the salary packages on offer for these AI roles are making even investment bankers blush. Exciting times!

This is my list of some of the best courses when it comes to AI for the financial services industry. I will focus mostly on course quality, but also on branding as that will have an impact on how your CV looks to potential recruiters.

1. Artificial Intelligence: Implications for Business Strategy from MIT

Who is it for?

This is more of a strategic AI course instead of technical one, meaning it is better suited for managers, leaders, consultants, bankers instead of coders and programmers. It focuses on AI strategy from a business perspective.

Course Review

The core focus is on using AI for business needs and solving business problems. Before AI can be used, your company needs to formulate an AI strategy and that is what this course is all about. You will learn to set goals, identify problems that AI can solve, investigate challenges that may arise during implementation, assess risks and approaches to address them, analyse the business value of this strategy, look at the time frames and other factors that are crucial to success.

The resource requirements of implementing an AI strategy also need to be a part of the equation and this course does a good job of helping you assess these requirements, whether they be technical or human resource related. You will also be taught how to set KPIs to measure performance of your brand new AI strategy and select metrics to gauge and tweak performance.

My favourite section is the Robotics in Business module which delves into using robotics for strategic advantage. It seems like we are at a point where this can be an actual business use case in a lot of industries and I find that fascinating.

The last few modules focus on just how AI is affecting businesses and society as a whole including ethical concerns and how work is done. Now that we have AI tools that are actually capable of that, these are very important lessons to learn. MIT is also an excellent brand to have on your CV and offers some solid personal branding opportunity. This combined with the course quality makes this a top recommended course for AI.

Click here and use code GS-AF-BBD15 for a 15% discount on this course!

Summary

| Time to Complete | 6 weeks, about 6-8 hours per week |

| Format | Self-paced, fully online |

| Level | Executive |

2. Artificial Intelligence Programme from Oxford University

Who should take this?

This course is ideal for business leaders and managers in any industry where AI is relevant or potentially useful. Its a mixture of business and technology and aims to bridge that gap for non-technical users.

Course Review

AI and ML can be a complicated topic for non-techies to understand and this is an excellent imitative to help solve that problem. If you are a senior manager on the non-technical side and you want to learn about AI, then this a solid option for you to consider.

Topic coverage is as expected. AI definition, AI technologies, data and machine learning approaches to problem solving, neural networks, working with intelligent machines, use cases, impact of human involvement, supervised and reinforced machine learning and everything else that is relevant to the topic of AI in business. I advise you download the course brochure using the discount link below to get an idea of the topics being discussed at the bleeding edge of this revolution.

Ethics problems and other challenges are also discussed which is not only quite interesting but also highly relevant for reputation conscious business leaders. Some of these ethical challenges should be obvious to most, but there are also some interesting takes like algorithmic bias,

Click here and use code GS-AF-BBD15 for a 15% discount on this course!

Summary

| Time to Complete | 6 weeks, about 7-10 hours per week |

| Format | Self-paced, fully online |

| Level | Executive |

3. Artificial Intelligence for Trading from Udacity

Who should take this?

Recommended for traders, quants, wealth managers, portfolio/ assets managers, developers.

Course Review

A course dedicated to using AI for quantitative trading applications. There is a focus on portfolio optimization, natural language processing for sentiment analysis, using trading signals for your algorithms, back-testing and so on. In short, this course is laser focused on quantitative trading and it does that rather well.

There are a lot of mini projects that you must complete along the way which reinforces the learning rather well. Think of it as a Nanodegree program (which is what its officially called). It’s not just a course, its a more comprehensive and focused experience that requires greater commitment from the learner. However, the extra effort is proportionally rewarded with a superior understanding of the concepts which I would equate to completing a full time degree on the subject.

For example, your first project is to develop a momentum trading strategy after learning quantitative trading and generating signals from stock data. Then you move on to portfolio optimization, financial securities formed by stocks, including market indices, vanilla ETFs, and Smart Beta ETFs. Crucial trading concepts like factor investing, alpha research, sentiment analysis, and trade simulation is also covered in great detail. There is also a massive section on using natural language processing to generate trading signals! This is just top notch stuff if you are even mildly interested in trading.

Udacity also provides a lot of value-added services to students and this is not just a hands-off undertaking. You do real world projects and receive feedback. You have mentor support for technical issues and resume/ online professional profile reviews. This is not just a bunch of online videos being marketed as a course.

Click here to generate your personalized discount for this course!

Summary

- Time to Complete: About 6 months with 10 hours per week.

- Available fully online and on-demand. Complete at your own pace.

- Well suited for quantitative traders/ developers. Udacity provides additional technical and career mentor support.

4. Machine Learning from Stanford Online

Who should take this?

Recommended for machine learning enthusiasts and developers. This is a quant heavy course.

Course Review

If there was such a thing as a “famous course”, then this one would probably qualify. Its one of the most popular courses in the computer science world and a quintessential entry for the topic of machine learning.

It provides a broad introduction to machine learning including applications like data mining and statistical pattern recognition. Because of that focus on statistics, it does require basic math skills. The author is a well known name in the field and Stanford is as good as it gets when it comes to brand value.

The course covers areas such as supervised learning, best practices in machine learning and AI along with a number of case studies to apply those concepts. You will learn about parametric algorithms, support vector machines, kernels, neural networks, dimensionality reduction, bias theory, innovation process in machine learning etc.

Summary

- Time to Complete: Should take around 60 hours for most.

- Available fully online via Coursera’s eLearning platform.

- Excellent course focused on machine learning and statistical pattern recognition for various applications.

5. Professional Certificate in Computer Science for Artificial Intelligence from Harvard

Course Review

This course uses elements from Harvard’s legendary CS50 course (Introduction to Computer Science). Which makes it the best introductory course for beginners.

Part 1 covers general comp science concepts like algorithms, data structures, encapsulation, resource management, security, software engineering and so on. Part 2 is all about AI and machine learning and provides a good introduction to the field.

This is a great course if you want to just explore the field of AI before fully committing. It touches on a lot of aspects and real-world applications which should really serve to excite you or at least guide your path into the filed of AI and ML.

Summary

- Time to Complete: Should take around 50-100 hours for most.

- Available fully online via edX – a non-profit formed by Harvard and MIT.

- A good introductory course for AI. Excellent brand value.

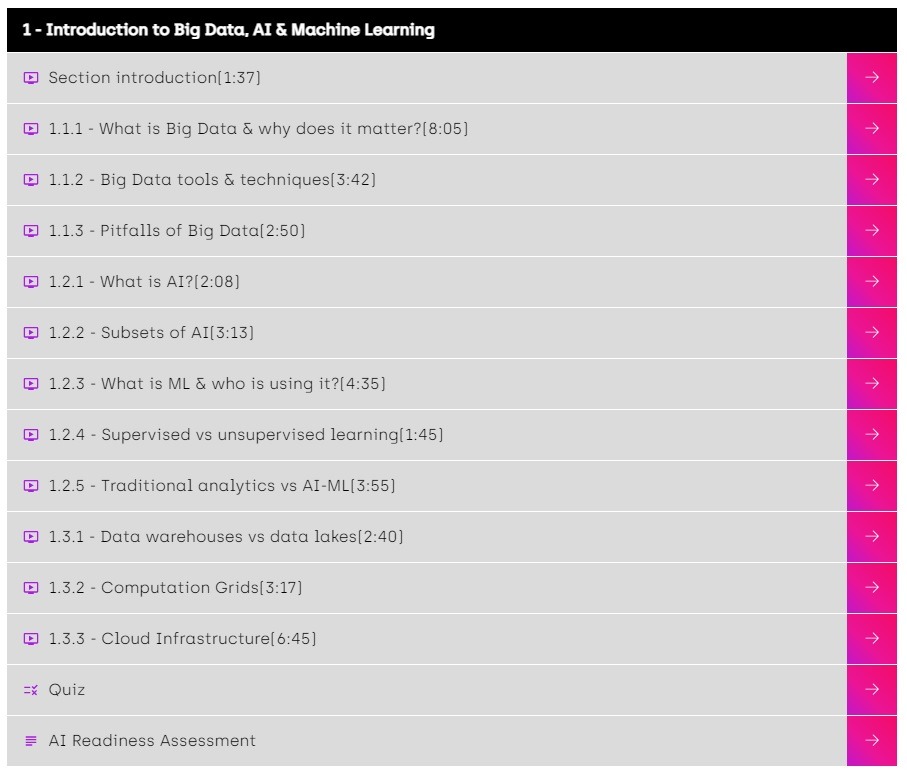

6. Big Data, AI & ML in Financial Services from Alqami & Delta Capita

Who should take this?

Best suited for corporate and investment bankers, middle management, business leaders, business owners.

Course Review

If you need an AI and machine Learning course specifically for the banking and financial services industry, then this is as good as it gets. This course has been created by Alqami and Delta Capita using their vast experience of dealing with real world AI and ML implementations. This is not just a theoretical course but rather provides real world insights into what AI, ML and big data means for the finance world.

The curriculum covers everything at the strategic level – from data governance to framework, tools, infrastructure, privacy issues and even quantum computing. There is a big focus on ethics, trusts and privacy which are topics that should definitely be on the mind of any business leader.

This is a strategic level course that has been designed for business leaders, managers, bankers and others who are not on the development side. It is meant to provide you with the understanding to have a conversation about these topics and to lead your team or organization down a path to using these technologies to maximize your business efficiency.

There are plenty of quizzes, white papers and case studies and I really enjoyed going through them. They really take you out of that academia zone and into real world territory and you feel like you are dealing with real world challenges and real world solutions to those problems. That is perhaps the biggest strength of this course.

Summary

- Time to Complete: Should take about 10-12 hours for most people.

- Available fully online and on-demand. Complete at your own pace.

- The best top-down view on this subject. Ideal for managers and investment/ corporate/ retail bankers who are on the business side of things.

- Created by industry practitioners using real world insights.

7. Deep Learning Specialization

Who should take this?

Best suited for developers and techies.

Course Review

This is a pretty well-known course in the AI community offered by Andrew Ng who is a bit of a legend himself. Stanford Professor, former Baidu Chief Scientist, founding lead of Google Brain – who better to teach you AI than this guy? The quality of the course and the teaching methodology itself is excellent which have contributed to the popularity of this course.

There are five modules covering several aspects of machine learning with an emphasis on neural networks. Deep learning and neural networks are especially important from a finance and FinTech perspective as they have wide applications in the industry.

While I recommend this course for beginners, it does not mean it does not cover advanced topics. You have everything from Convolutional networks, RNNs, LSTM, Adam, Dropout, BatchNorm, Xavier/He initialization and other ML topics to sink your teeth into.

Other topic coverage includes improving deep neural networks,

structuring machine learning Projects, convolutional neural networks and sequence models. You will learn how to build successful Machine Learning projects.

It also comes packed with several case studies that go into applying these concepts in real-world scenarios for different industries. It looks at AI implementation in healthcare, autonomous driving, sign language reading, music generation, and natural language processing etc. There is something for everyone here.

Summary

- Time to Complete: Should take about 80 hours for most people.

- Available fully online and on-demand. Complete at your own pace.

- You will be learning from one of the best instructors in the field.

- Recommended for beginners who want to be on the tech side of things including developers and tech leads.

8. Machine Learning for Trading Specialization

Course Review

This is a course custom built for traders who want to take their AI and automation game to the next level. Its been custom built for traders, wealth managers, portfolio and asset managers, hedge fund analysts and others involved in market trades.

The focus is on building algorithms for quantitative trading strategies that can be implemented and then trained to self-update using reinforcement learning concepts.

You need to posses a working knowledge of financial instruments and mathematical concepts. This would be considered an intermediate course.

Summary

- Time to Complete: Should take around 60 hours for most people.

- Available fully online and on-demand. Complete at your own pace.

- Course has been created by Google and NYIF in collaboration. That’s a good combo for FinTech.

Related Articles

- FinTech Courses

- AI for Business Courses

- Blockchain Courses

- Python Courses

- Cybersecurity Courses

- Data Science

- UI/UX Design