Relationship Managers form the backbone of any Corporate Banking institution. They are the absolute front end, the tip-of-the-spear of the Bank and the main contact points with the entire client base. There are a few different terminologies used for these roles – the coverage team, Relationship Managers (RMs) and sometimes just sales team – but they all refer to the same thing in banking.

1. Job Description

The role of a Relationship Manger is to “handle” the overall banking relationship with a client. I put handle in quotes because most of the time they are handling only the tough or tricky situations. They don’t often have to bother with the normal day to day minutia which is handled by the operations team an RM’s supporting staff. They do have to get involved, however, whenever a key business decisions has to be made or whenever the client gets stuck with something. This doesn’t really mean that RM’s are only there to wine and dine the client though. When a deal is being negotiated, an RM would have to spend the whole day working with the client. I am just trying to emphasize the fact that the RM doesn’t handle the day to day transnational stuff but rather is the overseer of the broader relationship with the client.

RMs really have to be jack of all trades though. Unlike product specialists who only have to stay focused on their particular product (like project finance for example), an RM has to know about every single product that the client is using and is likely to use in the future. For example, if a client needs to buy FX options, the RM has to know the basics and loop in the guy from the relevant team. And if the client now wants project financing for a new overseas factory, the RM has to know the basics and rope in the project finance guy. You are probably thinking this is a pretty tall order to fill and you would be right. But this is exactly why RMs are usually senior level people in the bank (especially with the larger clients).

In addition to being well versed with most products, an RM also has to be a great sales person. RMs have to build really strong relationships with senior management or owners at the client side to ensure that their bank keeps getting repeat and new business. They are also responsible for on-boarding new clients as well.

1.1 Coverage team structures

Different banks have different methods to structure their RM teams. The most common one is based on client size with client industry being the second factor. For example, Fortune 100 clients may be covered by a very experienced team of the senior most RMs. Then there might be a bucket for clients with USD >10 billion dollar of revenue and another bucket for 1 to 10 billion dollars of revenue and so on. This also makes sense from a product breadth and complexity point of view. An international conglomerate would need a lot more banking products than a local company which invariably would need fewer.

Within these segments, their may be a further distinction made based on industry. For example, one RM may just cover clients in the telecom industry while another looks at auto and so on.

2. Qualifications and Skills

Jack of all trades – As already mentioned, an RM has to know everything about banking. Most often, you are just chatting with the senior management at the client side and if you don’t know about something, it reflects poorly on the bank (which is why the senior-most people do the coverage for the large clients). And the conversation might not just be related to the products that your bank sells. I have had CXOs ask me about everything from exclusive credit cards to the future of the Argentine economy.

General awareness – Which beings us to the next skill requirement – knowing about everything that is happening in the world. Some clients like to discuss politics, some prefer sports and some just like industry gossip. It’s just how it is.

Client knowledge – Knowing about your bank’s relationship with the client is obviously mandatory. I have had clients ask me to replicate the same structure that our bank did for them in China or something. It’s not just sufficient to know only about your client either. You have to know about the entire industry they operate in as that can be critical when making a sales pitch.

Note: In case all of this sounds overwhelming, bear in mind that the larger your clients, the less of them you are expected to manage. For the largest coverage segments, an RM might only handle 1-2 main clients and 8-10 less active ones.

People management and getting things done– RM’s have to manage not only the client, but the internal teams as well. RMs are the ones who get the call from a client if something goes awry. And then RMs are the one who are expected to fix it. This usually involves coordinating with dozens of people – which could be credit analysts, one of the numerous product teams like trade or capital markets, compliance, the credit department, the back office and so on. An RM has to get things done or lose the business.

Credit skills – While it’s the credit analyst that does the heavy lifting, you still have to oversee him and help him if he gets stuck. The credit analyst usually works closely with the coverage team in most banks. This also applies for other product teams. For example, if a project finance project is going on, the RM needs to know the basics of that as well.

Working under pressure – RMs are the ones facing the firing squad when ANYTHING goes wrong. The client is unhappy? – the RM has to handle it, a compliance issue? – RM has to fix it and so on. RMs also have to hit revenue targets which just adds to the pressure.

Note: Again, all of this seems a bit overwhelming but remember that the RMs usually have a team of people assisting them. And the RM’s do get well compensated for all this headache! (We cover this in the salary and bonus section).

Relationship Skills

Technical Skills

Leadership Skills

Industry Experience and Market Awareness

3. How to become an RM?

Build a Resume for an RM role is a longer process compared to most other entry level roles. Its almost impossible to just get into a corporate banking coverage role fresh from college. You can, however, join as an assistant RM where your role would revolve more around helping the RM service his clients.

It might be faster to get there if you start working for a smaller regional bank though and there is nothing wrong with that. In fact, many people start out this way and it is no different from going up the ranks at the same bank.

3.1. Academics and Certifications

The academic qualifications can be a bit more flexible here. However, this is one role in banking where an MBA will help more than anything else. MBA is sort of a generalist course for business – you learn a bit of finance, a bit of sales and marketing, a bit of strategy, a bit of operations, and a whole lot of networking – you need all of these skills for a coverage/ relationship management role.

This requirement of being a jack-of-all-trades also means that you don’t necessarily need to have a specialization in things like finance or accounting or law like many other banking roles. Long story short, there is a lot of flexibility in terms of academic qualifications but having an MBA from a really good school will really help your chances.

3.2. Online Certifications

To become an effective Relationship Manager, you need to understand corporate finance. Following the principle of Jack of All Trades, you need to understand a bit of everything – some credit skills, some market knowledge, how capital markets work, forex, treasury, money markets, risk and so on.

The best course that gives you all of the above is the Online Professional Certificate in Corporate Finance from the New York Institute of Finance. Its an all-encompassing course that will get you ready to manage the finances and banking needs of multinational corporations. Nothing beats some on the ground work-experience, but if you are yet to break into banking, such certifications can give your CV the brand-value punch that you need.

I always emphasize having good, solid brands on your CV as they immediately catch the recruiter’s eye. Here are some resources to help you out:

Best Trade Finance Certifications/ Courses (2022) ranked by Bankers

3.3 Other Certifications

Moving on, you have to do a little bit of everything as an RM so technically a risk certification (like FRM) or a product specific certification might help but those are far less important when compared to your actual industry experience. A CFA might be nice to have, but an MBA from a good school is really what you need most. A lot of RM’s do rack up some certifications but the point is that it might only affect an activity which covers a mere 10% of their job description. Whereas for a credit analyst, a risk certification will affect 100% of their job activities. Still, certifications will never hurt if you can get them when you have the time.

You might have to do a lot of internal certifications though. Probably second only to the compliance function which we have covered in another article (where we also award them the accolade for having the maximum number of possible internal training requirements of any division!).

Since RMs have to sign off on client’s regulatory and compliance checks, they have to undergo formal trainings regarding those aspects. There are also a lot of product training programs that RMs might have to undergo. Frankly though, no one should be complaining about these programs as they are almost always super helpful especially since banks are not really stingy when it comes to hiring top tier trainers.

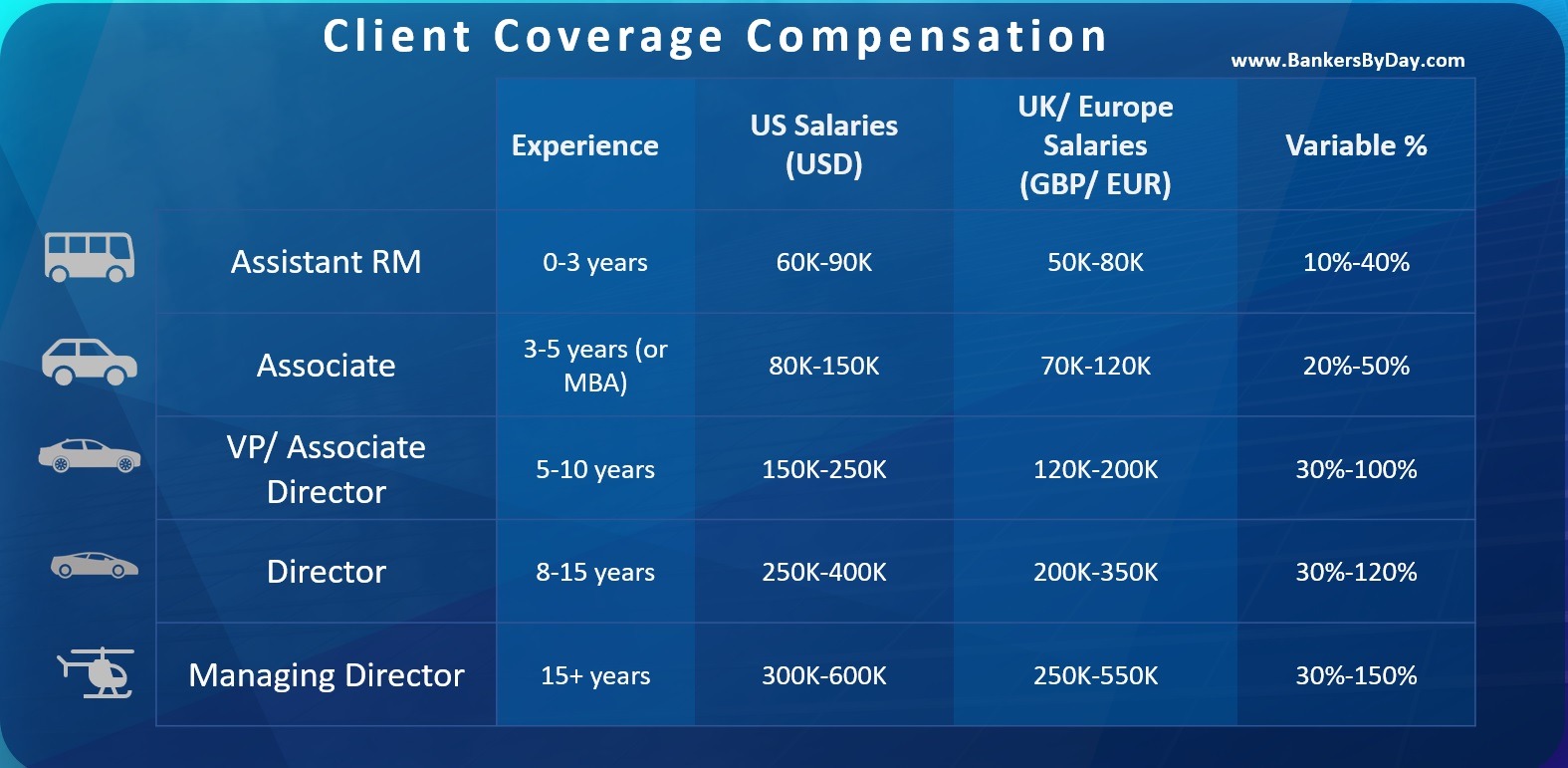

4. Salary and Bonus

As we have already discussed, RMs are the ones ultimately responsible for client revenue despite having help from a lot of other front-end product teams and back-end support teams. In banking, like many other industries, your salary is closely related to (or at least has a positive correlation to) the amount of revenue you generate. As the resident rain makers, RM’s get the most credit for that and their salaries usually reflect that fact.

It’s almost impossible to put an exact number for it like we have done for a lot of other roles. For the other roles, we have just stated that starting first year expected salary. However, the RM role is not a starting role and you might become an RM in 3 years or 10 years and even then your salary would depend on which client segment you are handling. It can be anything from USD 60K for a young RM handling local SMEs for a local bank to several million dollars for an RM handling Fortune 100 clients for a large multi-national banking behemoth. The average for most corporate banking RM’s would easily be north of USD 200K. My advice here would be to check the various job boards for specific banks and segments as it’s just too subjective.

As for the bonus, there is more good news! The RMs get above average bonuses which can be a significant percentage of their overall compensation package (might even be more than 100% in a good year). Assuming you meet your revenue targets, your variable component would certainly be more than almost all but a few product groups (like M&A, capital markets, private equity and a few others).

5. A Normal Day in Client Coverage

Do you like meetings? Do you LOVE meetings? You better learn to love them if you want to succeed as a Relationship/ Coverage Manager. To maintain the “relationship” with your clients, which is what your job title alludes to, you have to constantly be in touch. This does not mean you visit the CEO every day. It’s more about building a relationship with the entire top management and most importantly – understanding the client. Although banks compete on rates and service quality, at the end of the day the client is looking for someone who can solve their problems. That problem might be a funding requirement or a risk hedging one and the bank that understands them and their particular needs would always have a leg up.

This client focus is so strong that many bosses don’t even expect to see the RM’s at their desks but rather always out there building relationships with old or new clients. Outsiders often think that relationship management is simply a matter of schmoozing your clients, but it is more than that. The complex and interwoven nature of a client’s interaction with their bank mandates this closeness. Clients expect their bank to be someone who has their back and can help them be competitive.

Most of your client interactions would be regarding understanding their evolving needs and often pitching for new business. RMs don’t do this alone however. They will often take a product specialist along depending on what the client needs. Once the meeting is over, the next step is to make sure the implementation machinery is running. This involves informing everyone on what needs to be done, setting goals and timelines, estimating the revenue and risk and getting approvals if needed and so on. The RM acts as a project leader here and he cannot be expected to do all the work – but he does need to push others to make them give it their best.

There are also some internal housekeeping duties like ensuring the regulatory and compliance guidelines are met. Again, there are other people who assist in this role but ultimately it’s the RM who has to sign-off on the client documents. It’s the Relationship Manager whose name appears next to the client everywhere, including the revenue figures!

Which brings us to grand finale of this segment – the revenue targets. While every product team will have its own revenue targets for each client, it’s the Relationship Manager who has the responsibility for the overall client wallet share.

6. Career Path and Progression

Your career path towards an RM role has multiple routes which I would split into two main categories:

Lateral shifts – Start as a credit analyst or as an assistant to an RM who helps him with client servicing and then move to an RM role over time. This makes sense since you get to learn all the skills needed first before you graduate to take on the much broader responsibilities of an RM. It is also entirely possible to start with some other roles even in the various specific products teams and then shift.

The Management Trainee route would also be somewhat similar. You won’t really start as an RM but rather as an assistant to an RM and only after a few stints would you have the requisite project knowledge and leadership skills to take up an RM position.

Vertical shifts – Starting with a smaller bank and then moving up is entirely possible and many RM’s follow that route. One thing to remember though is that if you move from one client segment to another, you leave some of your reputation behind. For example, let’s say you are the credit manager handling the auto sector for the UK. If you move to an RM role, your clients would still be the same. However, if you move from handling the auto sector to something like tech or telecom, your clients would probably not know you as well.

Now that we know the career path towards an RM role, it’s time to asses the future prospects of an RM. (Hint: The prospects are good!) Most senior roles at a Bank would usually require some sort of Relationship Management or coverage experience. I don’t really have the data to support it, but if I were to hazard a guess, I would say it’s usually someone in the coverage role who has the highest probability of landing the head honcho role. After all, senior RMs are the ones who handle the biggest revenue clients for the bank.

7. Exit Options

There are some nice exit options as well. RMs can shift between segments and have the option to jump industries as well. We haven’t really discussed this much yet but many bankers do switch to roles at non-bank Fortune 500 companies just to get away from the stress. Companies also LOVE to hire bankers for their CFO positions or other senior finance roles. The broader knowledge base of coverage managers makes them ideally suited for such roles. Who better to negotiate with your banker than a former banker?