1. What is Corporate Banking?

Corporate Banking is the sale and subsequent servicing of banking products and services to large corporations. Large companies require services like mergers and acquisitions, capital market access, trade finance, supply chain finance, liquidity management, hedging and risk management and so on. These are the products and services that a corporate bank delivers to its clients.

Corporate Banking is usually structured along product and coverage groups. Product groups specialise in certain products like capital markets, securities, trade finance etc. Coverage groups are overall relationship managers that handle a few clients and usually specialise in a particular sector.

To visualise this, imagine a healthcare coverage group that covers large pharma companies, hospital chains etc. These clients might require foreign currency conversion, a project finance loan for a new facility, bond issuance, and hundreds of other such banking services. The coverage manager would deliver these services along with product specialists for each of these products.

1.1. How is Corporate Banking different from Investment Banking?

Investment Banking is a subset of corporate banking and involves the sale and servicing of a few specific products to corporations like securities, M&A services, DCM, ECM, LevFin etc. The distinction between investment and commercial banks existed in the US because of a federal law that was repealed a few decades ago. Today, most US investment banks offer the full suite of banking services to their clients. In Europe and Asia, this separation never existed in the first place.

Institutional Banking is also a subset of corporate banking where the clients are institutions instead of corporations. This includes financial institutions, multilateral institutions, religious or governmental institutions, NGOs etc.

2. List of Corporate Banking Careers

This is a non-exhaustive list of some of the careers available in corporate banking. The list is divided into front office roles (where you interact with the clients) and back office roles (where you have “internal” clients like the front office teams).

2.1. Front Office

- Client Coverage/ Relationship Management (usually sub-divided based on sectors like technology, resources, healthcare etc. Further bucketed based on client size.)

- Investment Banking product groups (M&A, DCM, ECM, LevFin, Restructuring etc.)

- Transaction Banking product groups (Trade Finance, Supply Chain Finance, Liquidity Management etc.)

- Securities/ Markets (credit, equities, foreign exchange, rates, derivatives etc.)

- Institutional Asset Management

- Real Estate

- Private Equity (Yes, some banks have their own PE teams)

2.2. Middle and Back Office

- Risk Management

- Compliance

- Credit Risk

- Research (equities, macro, credit etc.)

- Operations

Then of course there are dozens of other support functions like HR, marketing, accounting, IT and so on. But the ones listed above are the core corporate and investment banking roles.

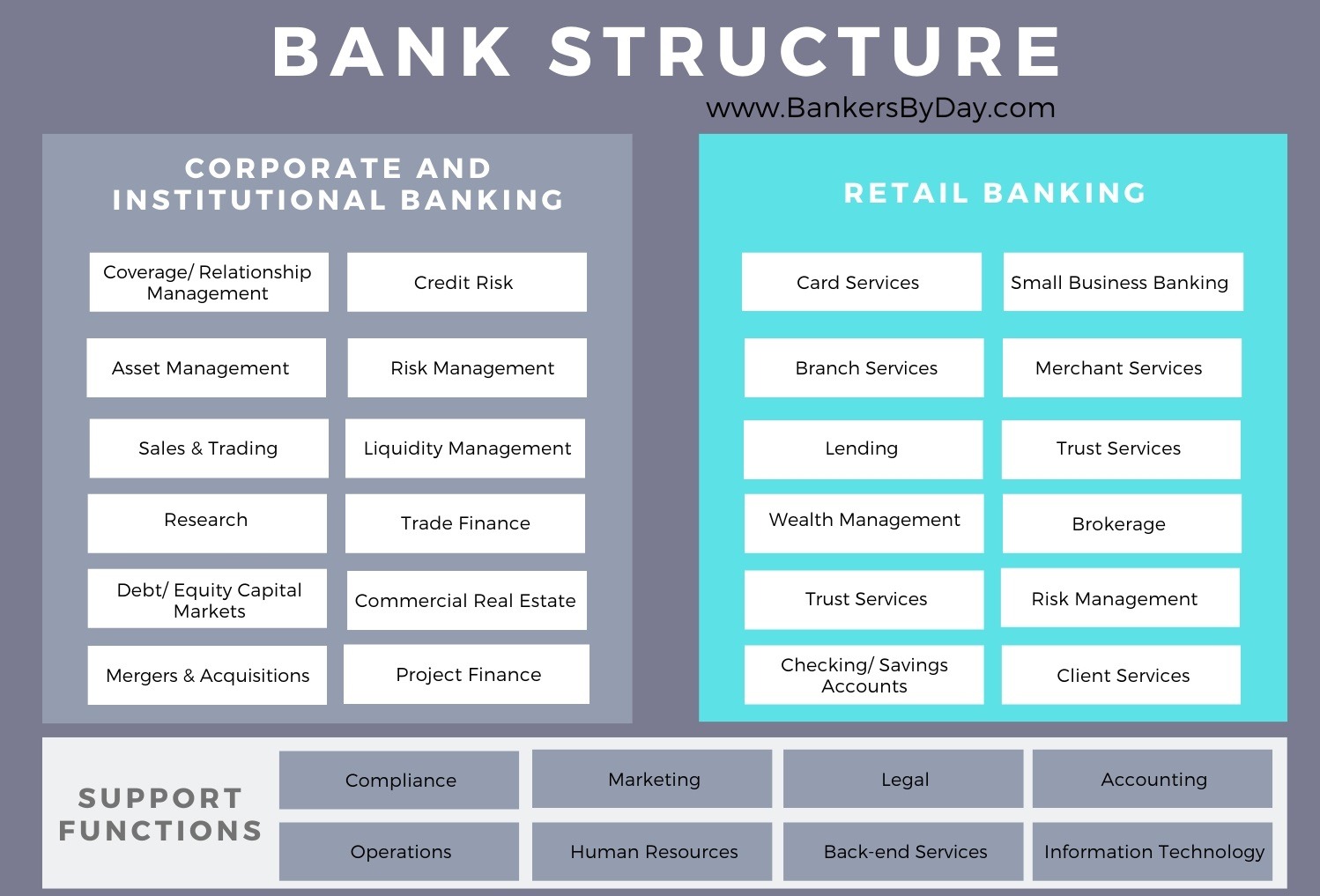

A full-service Bank

3. Why choose Corporate Banking?

There are dozens of roles within corporate banking and they are unique in terms of qualifications and skills, what you are expected to do, the ideal personality types, compensation, work hours etc. But at the end of the day, its all about one thing – providing banking services to corporate entities.

You should choose a role based on your interests and qualifications. If you are the salesy type and smart enough to understand complex products and deal with Fortune 500 clients, then a coverage role is ideal. If you instead like to just do your own thing at your desk and are highly numerate, then a research, quant or risk management role would be better suited. If you are willing to put in the grunt work and spend 100 hours at the office and get compensated accordingly, then consider some investment banking roles.

Each of these roles are detailed in their individual guides and I suggest you check them out based on what interests you.

4. How to get into Corporate Banking?

You need to focus on six things here:

4.1. Academics – Your college, your degree and your grades all matter here. This article lists some of the best degree options. There is a lot of competition for the most sought-after roles and banks usually only recruit from a few target universities for those roles. You can compensate for that by putting in some effort or looking at other roles.

If you need an extra boost, some courses and certifications will really help you out:

4.2. Internships – Internships are perhaps the easiest way to give yourself a little boost. It doesn’t cost much for the banks to offer internships and it’s a low commitment activity for them. So, do all you can to take advantage of this. This article goes into more details about how to prepare and land finance internships.

4.3. Work Experience – This is actually a double-edged sword. For entry level analyst roles, banks don’t want experienced people. They want fresh graduates who are just starting their careers and willing to put in long hours. But for other more senior roles, you will need to have relevant experience.

4.4 CV Building – Yes, this is important enough to get its own bullet point. You need to spend at least 50 hours fine tuning your CV. It’s hard to stand out unless you are at the top of your class at Harvard or Oxford. You need some sold brands on your CV and squeeze each line for every drop of juice.

If you need extra help with your CV, these professionals services offer the best options for finance careers:

Best Resume Writing & Review Services for Investment Banking & Finance ranked by Bankers

4.5. Networking – If you are good at networking, that makes things a lot easier. Think of it like a force multiplier. You get more opportunities, you get better access to information and from the bank’s perspective, you are a known variable.

4.6. Interviews – Interview here represents the entire selection process. Written tests, group discussions, case studies, interviews – everything. This can be a tough nut to crack for some, but some people are just naturally better at it. They key is combining confidence and preparation in equal parts. This article will help you figure out the thought process to answer some questions.

5. Corporate Banking Career Path

This is the traditional career path:

Analyst – This is where you start after an undergraduate degree. Being an analyst is all about learning the ropes, fetching coffee and working long hours. But that is not much different from most other top tier careers like medicine or law.

Associate – This is where you start with if you have a master’s degree. Even analysts usually need to get an MBA or something to eventually reach the associate role. This is the actual start of your career where you are more than just an office grunt and do some real work. The hours and work are better and you are allowed to think for yourself.

Associate Director/ VP – This is where you can start making a real difference and get to take meaningful decisions. Not client level decisions, but at least on the operational and execution level. This is also where you begin to cement your understanding about client industries and business in general. The downside is that it becomes increasingly harder to switch roles after this point.

Director – The first real leadership position. Most Directors will have a small team reporting to them and your focus shifts towards management and leadership, in addition to managing escalations and revenue targets. Most will hit this level in their mid-thirties, and this is when life starts to cruise along.

Managing Director – Not everyone really makes it to this level since the number of roles are limited. This is when you lead entire departments and should ideally be earning seven figures. The pressure is to perform is very high though. You are expected to bring in hundreds of millions in revenue each year and you are constantly under threat from others who can supposedly do better.

5.1. Role hopping

There is another way to look at career progression and that is based on roles. For example, you may start as a credit analyst and then jump to a DCM role as an analyst as well. While you are still an analyst, your compensation will likely increase, and this may be considered a career jump.

This happens the other way around as well. For example, let’s say you are stuck at the AD level in some department because no one above you is really moving. You may decide to jump to another related team just to get to the Director level.

5.2. Moving up the value chain

Clients are bucketed based on revenue and assigned to sub-teams. You may have a team for clients between USD 200 million to USD 2 billion in revenue. Another one for USD 2 billion to USD 20 billion and one for USD 20 billion and above.

Corporate bankers may move up and down this chain based on what they think is bets for their careers.

6. Corporate Banking vs. Investment Banking Careers

Although investment banking is a subset of corporate banking, it is rather distinct from a career perspective. Investment Banking roles are harder to get into, will almost always pay better and usually have way worse hours and work life balance.

6.1. Compensation

The difference at the analyst and associate level is not that large because your compensation is not linked to how much money you bring in. But as you progress to Director or MD levels, the difference usually increases significantly. That being said, top performing Corporate Banking MDs can still bring in north of a million dollars. But their average would be much lower than the IB guys.

At the end of the day, how much you make depends on how much money you bring in for the bank. When there is a lot of deal flow, investment bankers can easily make it rain. But when the times are lean, deals dry up and they get the axe way before the corporate banking guys.

6.2. Work-Life Balance, Quality of Work

Corporate banking roles win by a landslide here. A big part of the problem with most investment banks in the US is the culture. In Europe, IB culture is much more chill compared to the US. Asia is somewhere in the middle.

Corporate banking guys also get to interact with clients way earlier than the IB guys. IB analysts and associates usually just spend all their time poring over documents. That being said, its not like Corporate banking associates are signing billion dollar deals on their own. They do get to interact with the clients more but its mostly about client servicing and handling their issues.

6.3. Future Prospects and Exit Options

In terms of career prospects, its a toss up between the two. Since the last financial crisis, risk management roles have seen better focus and growth while IB has languished, relatively speaking. Relationship management and coverage roles have also done better since they are more generalists roles.

Exit options are generally better for IB though. You get to work on a lot of deals and that makes you valuable to private equity firms and such. However, the competition to get in can be high and most PE shops hire directly from campus these days.

7. Corporate Banking vs. Retail Banking

Retail banking cannot compare in terms of compensation to corporate or investment banking. But it is a lot easier to get into since there are many more retail bankers than there are corporate/ investment bankers.

In terms of future prospects, retail banking is definitely facing a lot more pressure. Bank branches are being downsized in favour of exponentially cheaper online options. Secondly, retail banking is volume driven and big tech companies are really good at automating that.

That being said, some roles within retail banking are doing very well. Have a look at these linked articles on financial planning and wealth management roles. Essentially, the common theme is roles that require a personal touch will do well while repetitive tasks that can be automated will go away.