FinTech has undoubtedly been one of the most disruptive forces to ever hit the mainstream banking and finance sector. Sure, there have been recessions and regulatory overhauls and even multi-billion dollar fines, but FinTech is what is really chipping away at the core businesses of the banks. The disruption is not just restricted to payments anymore, everything from direct lending to investment banking is now being targeted by FinTech start-ups.

Then we have cryptocurrencies and, more importantly, blockchain technology that has the potential to change the way consumers look at finance. Even if the cryptocurrencies themselves crash and burn, blockchain technology can definitely find a way into the mainstream and may be re-purposed by tech companies to achieve stunning results. But if you are a tech-savvy banker or a finance-savvy techie, then all of this is just another great career opportunity!

1. What is FinTech?

FinTech is the application of digital technologies to deliver financial products and services. Over the last two decades, the adoption of technologies like the internet, mobile and cloud computing has drastically transformed many industries.

When it comes to retailing, the tech-retail hybrid is called eCommerce and when it comes to banking, the new hybrid is called FinTech. That’s what FinTech essentially is – a hybrid industry that is using the advantages of technology to better deliver an existing product or service.

2. How to start your FinTech Career

Getting a high-paying FinTech job is dependent on your skill level and how well you can showcase that skill to your employers. You would want some specialised training if you want a shot at the best paying jobs. FinTech is a fast paced and rapidly changing industry and the winners are those who are always ahead of the curve. Unlike mainstream banking which is mostly about your academic performance, FinTech requires demonstrable skills.

If you are looking for course recommendations, the article below has some course reviews and pretty much everything you need to hit the ground running. In addition to the great course content, the brand value will also help you stand out. You can read my detailed review of all the top courses, along with other options, using the links below:

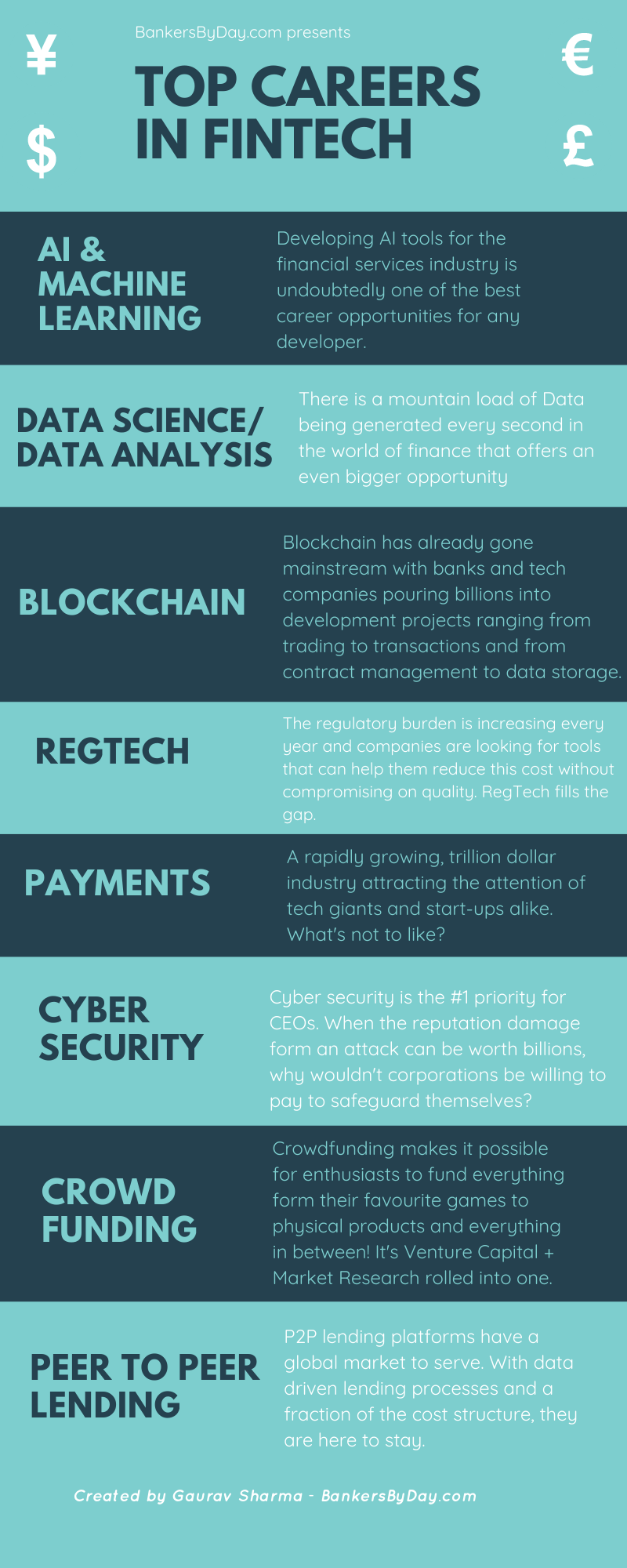

3. Top Careers in FinTech

FinTech firms are different from BigTech both in terms of their size and in terms of their focus. FinTech firms focus exclusively on using tech for financial products and services unlike BigTech firms for whom offering financial services is just a small value-addition for their customers. FinTech’s specialise in so many different ways that a general analysis of them would hardly do them justice. A more nuanced look into each category is needed.

3.1. Data Science and Analysis

Every year, we set a new record for the amount of data generated. Trillions of online transactions ranging from purchases, bookings, subscriptions, payments, transfers, trades etc. flow through the global banking system. This mountain of data is worth its weight in gold, if it can be properly analysed and covered into meaningful information.

That is where data science comes in. Because of the extremely rapid pace of advancement in data science and analysis, there is a severe shortage of experienced professionals in the filed. Data scientists are thus being offered very lucrative packages by everyone from the tech giants to banks and startups.

Data Visualisation is a related field which is all about data-driven storytelling and using data insights to drive consumer behaviour. its a mix of a technical roles and a marketing one and it is certainly one of the most unique and interesting combinations.

Career prospects – Phenomenal. The unique aspect of data science is that your skills are transferable across industries. Banks/ FinTech firms are just one of the many employers who are tripping over themselves to get their hand on you!

3.2. Artificial Intelligence & Machine Learning

AI can be both a force multiplier and a competitor for banks or just about any industry for that matter. What we have right now is not really true AI but just rule-based algorithms. Companies are developing machine learning which would allow the AI to learn those rules on its own and that can really blur the line between what is just a rule based algo and something very close to how we think.

The risks and possibilities here are endless and but for now, it just makes sense to look at the technology that we already have and that itself seems promising. Chatbots and robo-advisors are probably more useful when catering to the low end of the market. But at the higher end, you need more advanced tools which can scan mountains of data and spot patterns. That is something that can be very useful for the mainstream and it is indeed something that is already being used.

Career prospects – Phenomenal. Techies with the right skills are already in high demand because both BigTechs and big banks are scrambling to develop such tools for data analysis and transaction monitoring etc.

3.3. RegTech (Governance, Risk and Compliance using tech)

Regulatory costs have really skyrocketed since 2008 and guidelines and rules have become a lot more complex. The very reason that RegTech exists is to simplify the process of compliance and monitoring using advanced tech tools. We are talking about everything from machine learning/ cognitive intelligence to super-fast algorithms that can monitor millions of transactions in real time and detect the signs of fraud in milli-seconds.

In that sense, RegTech is not really a competitor to banking, but rather a force multiplier and a valuable tool. Considering the vast sums that banks spend on compliance, RegTech is likely to be a darling amongst investors.

Career prospects – Excellent. You aren’t really competing with banks, you are helping solve their problems. And considering how expensive these problems can be for banks, this is a great niche to be in.

3.4. Cyber Security

Multiple industry surveys reveal cyber security to be one of the main threats to businesses. In addition to losing valuable data, the biggest blow actually comes from the reputational damage that a cyber security breach can cause. Which is why FinTech and tech companies developing solutions in this field are doing rather well.

We are becoming ever more connected and reliant on digital devices. With the Internet of Things breaching the 20 billion devices mark, cyber security is now more important than ever. In my opinion, this field has the most potential for growth along with RegTech in the coming years.

Career prospects – Excellent. Companies are more worried about cyber security than ever before and willing to spend more money to protect themselves. It’s a challenging niche to break into as a start-up if you intend to develop your own software. But you can probably start out by targeting smaller companies and selling them ready-made solutions and just provide the training.

3.5. Algorithmic Trading/ HFT

Trading volumes have exploded over the last few decades as computers have taken over the bulk of the grunt work and can process millions of transactions per second. We have reached a point where a single milli-second can make a difference and trading firms spend millions of dollars just to be able to shave off a few milli-seconds off their automated trading platforms.

Algorithms crunch mountains of data and queue up tens of thousands of trades. But you still need someone to create, manage, optimize and tweak these algorithms. These professionals are a mix of traders and programmers with specializations in computer science, math or even physics. There is always a shortage of skilled talent at the very top end and you can command quite a premium if you can offer something that no one else can.

Career prospects – Excellent. The demand for algorithmic traders will only keep on increasing as more and more specialized programs need to be developed in an ever-changing world with a myriad of asset classes, jurisdictions and correlations to manage.

3.6. App Development

People spend an average of 7 hours online each day, the majority of that on mobile. Is it any wonder than that companies are pouring billions on mobile app development and pushing those out to as many users as possible? Over 200 billion mobile apps downloads happen each year, most of them for Android followed by iOS. This is the size of the market.

And it’s not just about downloads, its more about the hundreds of billions that is spent on these apps for shopping, banking, entertainment, services etc. Banks and FinTech firms are falling over themselves trying to create powerful and visually appealing apps to attract and retain customers. While there are plenty of app developers out there, what is lacking is quality. If you are a quality app developer, you got it made.

Career prospects – Good. The demand for app developers has been skyrocketing prompting many young graduates to opt for such careers. But there is a shortage of highly skilled and highly competent developers and they are the ones commanding the highest salaries.

3.7. Electronic Money Institutions (Payments, Wallets, Money Transfers)

EMIs have been gaining ground because they address the biggest issue with traditional banking – onboarding woes, fees and customer service. You can get en EMI account opened in minutes (I have tried this personally). To be honest, I have no issues with any local banks as well but the advantage of EMIs comes into play when you are dealing internationally. If you are a small business owner who needs accounts in multiple currencies, needs to change between them and pay vendors internationally, that is when EMIs start to shine.

Most EMIs just provide the tech and customer service front end. The core banking is still provided by an actual bank in the background which holds your money and is guaranteed and regulated by the local government. That is what makes EMIs wonderful. They are the best of both worlds.

Payment processing is a sub-segment and it is what I consider to be low hanging fruit. As a payments processor, you are not concerned about anyone’s credit worthiness, you only move funds that are already there. It’s also something that’s much easier to convince consumers to trust you with, at least in comparison to other banking services.

It’s not surprising then that FinTech firms have made significant inroads here, although credit cards still rule the roost. But here’s the deal – as credit cards were gaining popularity years ago, banks all over started launching their own credit card divisions and now they are doing the same with payment processing and offering one-click payment options.

Career prospects – Good. There are dozens of EMIs cropping up in friendly jurisdictions like the US, UK and Lithuania.

3.8. WealthTech and Robo-advisors

WealthTech is the love child of the Wealth Management and Financial Advisory industries coming into direct contact contact with modern Tech-enabled service delivery. These industries are volume-driven for the most part and success depends upon making as many recommendations as possible to the client and maximizing commissions.

Technology and robo-advisors prove quite useful here, especially for the younger generations which is perfectly fine with just interacting over a chat screen rather than needing to meet face-to-face or even getting on a call.

Other advantages include 24/7 access, advanced data analytics tools, and only when you need to escalate, you still have access to your human wealth manager or financial advisor.

Career Prospects – Excellent. The industry is going rapidly at around 25%-30% each year and there is plenty of untapped potential.

3.9. Blockchain and Cryptocurrencies

Blockchain is the underlying bedrock that makes cryptocurrencies possible. Think of blockchain as a core technology like, say, the internet and cryptocurrencies are just one application of that tech. The future of cryptocurrencies is still uncertain but blockchain is something that I definitely see being used for many applications in the future.

The blockchain is just a more secure way to record all sorts of data and transactional information. It’s very resistant to attacks and outside tampering and that is why I feel it can be used in everything from payments to land records to contracts management and so on. However, to really make it big, blockchain needs attention from large tech companies and banks to promote or at least fund development.

Right now, the funds are being crowdsourced and like with any industry, most of the ventures fail which has really reduced the appetite of common people to invest in ICOs. This is why I feel that specialised investment funds need to be created to invest in these projects which can do adequate due-diligence and risk management rather than relying on just a website and a few YouTube videos.

Career prospects – Good. The funding model needs a shakeup but the core tech is rock solid.

3.10. Peer-to-peer lending

P2P lending is another fan favourite and something that has really exploded in recent years. It is perhaps the biggest potential disruptor for banking and that is great news. As I have highlighted previously, payments oriented FinTech firms forced banks to revamp and modernize their own systems and if P2P can do something similar for lending, more power to them!

The real challenge for P2P lending is risk management and providing adequate risk adjusted returns. It’s hard to monitor the end use of funds and even harder to go after defaulters online. So it’s up to the individual P2P platforms to ensure that they can provide their investors with adequate risk adjusted returns and the ones that can do that, deserve the business!

Career prospects – Decent. Another niche with high potential. There is a tremendous gap in funding especially at the lowest end of the market where it is just not profitable for banks to spend the resources to analyse tiny loans. An awesome tech platform can do wonders here (and many already are).

3.11. Crowdfunding

Crowdfunding is not really taking away business from banks as they probably wouldn’t have funded these high risks projects anyway. The beauty of crowdfunding lies in the democratization of the funding process. The problem though is that that might not necessarily be a good thing. It might make sense for some projects (I am a Star Citizen backer myself), but every-day consumers just aren’t going to do the necessary due-diligence, background checks, competitive analysis and so on before putting down the cash.

The reason for this is that their individual exposures are usually low enough that it wouldn’t matter if they lost the money. But it can still amount to a lot of money when pooled together. So in conclusion, I see crowdfunding as an awesome tool since it allows the funding of very niche projects that otherwise wouldn’t see the light of day. But scams and disappointing crowdfunding projects are the biggest hurdles that this industry needs to overcome on its own.

Career prospects – Decent. There is still a lot of untapped potential here. The key is to increase the success rate of the projects on your platform so that people don’t just shy away from investing.

5. Highest paying FinTech jobs

When it comes to compensation, there are a tonne of factors to consider. Your location, your experience, what sort of company you are working for, what exactly is your role and so on. So we’ll have to look at things from a strategic angle.

Entrepreneurship – If you want to make the most money, your best bet is entrepreneurship. If you start a FinTech company and it takes off, you can easily be worth millions. There are even billionaire FinTech entrepreneurs but that is rare. I dont really want to discourage anyway but most startups (in any field, not just FinTech) usually end up failing. But a lot can do well enough that their bigger competitors are willing to buy them out for millions of dollars. That is actually the most common exit route for FinTech entrepreneurs.

FinTech leaders/ strategists/ consultants – Leadership roles obviously pay more than entry or mid level roles. People with experience demand and deserve a premium for the experience they bring to the table. These are senior roles at the Director, Vice President or equivalent level. The actual title varies from company to company but their role is to champion the implementation of FinTech strategies or products. They usually lead a team of people which includes programmers, designers, researchers etc. I do some FinTech consulting myself! Salaries are generally $300K+ and going up to $800K.

FinTech programmers – These are the guys who do the actual grunt work. Grunt work is sort of an unfaltering term though as the programmers are the ones who make the magic happen but its meant to represent the fact they are the actual creator of FinTech products and services. Its mostly a development job and while some roles are more research heavy, some programmers just spend more time with maintenance rather than actual development. Depends on the role really. Compensation is good and dependent on what you are brining to the table and what sort of company you are working for. BigTech firms and Banks usually pay the best but its harder to break in. Expect anything from $80K to $250K based on your experience and skills.

6. FinTech Career Paths

6.1. Working for a Bank

Banks are not taking the FinTech disruption sitting down. Billions are being poured into development, innovation and acquisitions.

Banks have the advantage of knowing the finance industry inside out and will give you the resources you need to help them compete (and compensate you pretty well).

6.2. Working for a BigTech firm

This gives you the option to have significant resources as well as large teams working with you. The downside is that you are an employee and you would be restricted to work on what your employer wants you to work on.

However, I still think this makes sense for someone early in their career just trying to learn the ropes while still making a decent wage doing it. It doesn’t really have to be a BigTech firm but any sizeable company that has an active development effort in the financial space.

6.3. Going solo

This sounds interesting at first, but it can be really hard on your finances (unless you have a lot saved up). Yes, you can find investors but you do need a working concept for that and developers end up losing a significant stake and from my interactions, they often regret that.

6.4. Working for a start-up

This is the middle ground between the other two options. The skill barrier to get in can be high though and budgets may be tight, but you can ask for a stake. If the company makes it big, or more likely agrees to a buyout of some sort, you can have the seed capital to start on your own.

6.5. Switching industries

If you are already working on apps or software in other industries, you may be able to leverage your experience to get in even at higher levels. The choice that you have to make is which industry offers more potential – the one where you currently are or something in the FinTech space. You might be especially valuable if you have experience in a high demand field like AI development.

7. Is FinTech a good career option?

FinTech is an excellent career options for tech savvy developers and entrepreneurs who can think of new ways of delivery financial products and services. Whether you should pursue a career in FinTech develops solely on your personal interest and skills.

FinTech is an excellent career options for tech savvy developers and entrepreneurs who can think of new ways of delivery financial products and services. Whether you should pursue a career in FinTech develops solely on your personal interest and skills.

- Do you enjoy the intersection of finance and technology?

- Are you open to keep learning new technologies every few months and willing to keep up with the fast pace of the tech world?

- Can you think of new and innovative ways of delivering existing products and services?

- Are you able to work in an unstructured business environment that feels like a start-up?

- Are you a multi-disciplinarian who can combine finance, tech, legal, marketing, and other business skills to succeed?

If your answer to most of those questions is a yes, then yes, FinTech is a great career option for you. FinTech also offers unmatched future potential as the next few decades will be all about transforming old industries into new, tech-driven ones. That does not mean traditional finance jobs will cease to exist. It just means they will be transformed and require a lot of more tech skills.

8. Who is hiring in FinTech

BigTech is the term used to define the big technology behemoths like Facebook, Amazon, Netflix, Google (aka the FANGs) among others. Many of these companies have a massive global customer base and they are using their reach to sell new products to their customers. This includes services like digital wallets, payment processing and online sale of financial products. This is the first driver of FinTech.

The second driver is the collection of hundreds of small FinTech firms that have come up with solutions to solve real problems like cyber security and friendly user interfaces. The last main group of drivers are the banks themselves. They don’t want to be left behind and are trying to replicate the success that tech firms have had.

9. Biggest FinTech Career Hubs

London is by far the biggest fintech hub. The City is already the financial capital of the world and this has allowed it to dominates fintech as well.

San Francisco is a close second. Being the tech hub, it is no surprise that so many FinTech companies are based here. California is also home to a lot of BigTech companies and these are also investing heavily into FinTech. Next, we have the various financial hubs like New York, Los Angeles, Singapore, Hong Kong, Sydney, Frankfurt, Paris, Mumbai etc.

10. The Future of FinTech

FinTech is here to say and no one with any actual understanding of the industry will deny that. The real question is that in what way, shape or form will it evolve. Would it be the tech giants encroaching upon the bank’s traditional territories? Would it be banks taking back control and seeking out the right partners to help them develop the right technologies? Or would FinTech companies be able to carve out niche markets of their own and resist pressure from the heavyweights?

As of now, it seems like there is going to be a bit of everything. There are certain products where banks have an undeniable advantage and those revenue streams aren’t going anywhere anytime soon. While other products which are basic enough to be managed through automated processes are likely to be the main targets of the tech-savvy challengers.

It’s important to remember that a big chunk of bank revenues come from their advisory and corporate/ investment banking businesses. These businesses are harder to target because they can’t really be automated, at least not with today’s AI. From a career perspective, the bottom line is that FinTech should be considered a great opportunity and people with the right experience would be highly sought after by banks, tech companies and new start-ups alike. In this three-way tug of war, the financial technology expert wins either way.