Sustainable finance and impact investing have gained significant popularity in recent years as investors increasingly seek to integrate environmental, social, and governance (ESG) factors into their investment decisions. This growing trend reflects a shift towards a more holistic approach to finance, where the aim is to generate positive social and environmental impact alongside financial returns. As concerns about climate change, inequality, and ethical business practices continue to rise, more investors are recognizing the importance of considering non-financial factors in their investment strategies, and the demand for professionals with expertise in sustainable finance and impact investing is growing.

To quote John Mackey, CEO of Whole Foods and author of Conscious Capitalism:

Most people in the twenty-first century (especially those who are well educated and reasonably affluent) want to work for more than just a paycheck. They crave work that is stimulating and enjoyable. They’re looking for meaning; they want their work to make a difference, to make the world a better place.

Whether you’re looking for meaningful work or want to learn more about the growing ESG movement and its relationship to finance, read on to find out more about sustainable finance and impact investing.

What is Impact Investing?

Impact investing is a financial strategy that seeks to generate both financial returns and positive social or environmental impact. This approach goes beyond traditional investment models by actively seeking opportunities to support businesses and organizations that address pressing global challenges, such as climate change, poverty, and inequality. Impact investors prioritize measurable, beneficial outcomes alongside financial gains, often targeting sectors such as renewable energy, sustainable agriculture, affordable housing, and healthcare. This growing movement is driven by the belief that capital can be a force for good, and that by aligning investments with values and goals, individuals and institutions can help create a more sustainable and equitable world.

Impact investing encompasses a range of investment approaches, including venture capital, private equity, debt and fixed income, and public market strategies. These investments can take the form of direct investments in social enterprises or businesses with a strong commitment to sustainability, as well as investments in funds and financial products designed to generate positive impact alongside financial returns.

Impact investing typically adheres to a set of key principles, such as intentionality, measurement, and transparency. As a growing niche industry, impact investing seeks to intentionally generate positive social or environmental impact through investments and rigorously measure and report on the outcomes of these investments. Strategies for impact investing may include shareholder engagement, community development investments, and ESG integration. These strategies can vary widely based on the specific goals and priorities of individual investors and organizations.

My first exposure to impact investing came in college when I learned about colleges divesting from fossil fuels. Impact investing is, to me, a very real way to make positive impact. No matter what you believe in, money matters, and I believe that what you put your money behind, you support. My own money is carefully managed by me in funds and stocks that I would willingly give money to. While it’s impossible to meticulously vet every single business activity of every single stock in a fund, that’s why impact investors exist – to help you manage your money and support the companies, industries, and causes you care about.

What Kind of Careers Can You Pursue in Sustainable Finance and Impact Investing?

This field is new enough that the industry is growing and new jobs and job titles are being created every day. Sites such as Green Job Search and EcoJobs sometimes list relevant jobs, and LinkedIn is a great resource for browsing jobs and qualifications as well to start to get an idea of the available jobs that might fit your background and requirements. There are various career opportunities available, including:

- Sustainable Investment Analyst: Responsible for evaluating and analyzing companies, projects, and investment opportunities based on environmental, social, and governance (ESG) criteria.

- Impact Investment Fund Manager: Manages funds that specifically target sustainable and socially responsible investments, aiming to generate positive social and environmental impact alongside financial returns.

- ESG/Sustainability Specialist: Works within financial institutions to develop and oversee ESG integration strategies, ensuring that investment decisions consider environmental, social, and governance factors.

- Corporate Social Responsibility (CSR) Manager: Responsible for developing and implementing sustainable business practices within organizations, often including managing impact investing initiatives.

- Green Finance Advisor: Provides financial advice and expertise to companies and investors seeking to finance and invest in environmentally friendly and sustainable projects.

- Impact Measurement and Reporting Specialist: Focuses on tracking, measuring, and reporting the social and environmental impact of investment portfolios and projects.

- Sustainable Development Researcher: Conducts research and analysis on sustainable finance, impact investing, and corporate sustainability practices, contributing to the development of industry knowledge and best practices.

- Environmental Economist: Focuses on understanding and addressing environmental issues through economic analysis, measuring the costs and benefits of environmental policies and projects.

These careers typically require a combination of finance, investment, sustainability, and ethical investment knowledge, and may be found within financial institutions, impact investment funds, consulting firms, non-profit organizations, and corporate sustainability departments. Even in the public sector and voluntary sector (like with NGOs) there are emerging jobs and green financing projects. Educational backgrounds in finance, economics, environmental science, sustainability, or related fields can be beneficial for pursuing these careers.

Education Required for a Career in Sustainable Finance and Impact Investing

A career in sustainable finance and impact investing will usually call for a strong educational foundation in finance and sustainability. However, even if you don’t have a finance or sustainability degree, relevant job experience such as working as a financial analyst or working in a sustainability office will give you a leg up.

Additionally, certifications such as the Chartered Financial Analyst (CFA), Certified Public Accountant, or Certified Internal Auditor, or something more specific like a Certificate in ESG Investing or a Chartered Sustainable, Responsible, and Impact Investment (SRI) Counselor can demonstrate expertise in incorporating ESG factors into investment decisions. We recently put together a list of relevant Sustainable Finance/ ESG Courses & Certifications that can help you become a desirable applicant.

Best Sustainable Finance/ ESG Courses & Certifications (2023)

Specialized training programs such as those offered by the Global Impact Investing Network (GIIN) or the Sustainability Accounting Standards Board (SASB) can further enhance understanding and application of sustainable finance principles. And advanced degrees such as a master’s in finance, sustainable finance, or impact investing can provide you with a leg up as the competition in this field grows.

My personal educational journey is a BS in Environmental Studies and Biology: my multidisciplinary Environmental Studies degree helped me develop my writing as well as a broad understanding of sustainability policy, literature, history, and finance, while my science degree helped me develop an analytical mindset.

Skills Required for a Career in Sustainable Finance and Impact Investing

Those interested in pursuing a career in sustainable finance and impact investing should possess a combination of financial acumen, understanding of environmental and social issues, and a commitment to ethical business practices. That being said, given the variety of careers in this field depending on the work you want to do, there are also plenty of different skills that are relevant.

- Financial literacy: Professionals in sustainable finance and impact investing must possess a strong foundation in traditional finance and investment principles. This includes a deep understanding of financial markets, risk management, and valuation methodologies.

- Environmental and social awareness: A thorough understanding of ESG factors is essential for evaluating potential sustainable investments and their impact on communities and the environment.

- Ethical leadership and decision-making: Professionals must exhibit strong ethical standards and the ability to make informed, sustainable investment decisions that align with their clients’ values and broader social and environmental goals.

- Communication and interpersonal skills: This may go without saying, but effective communication with clients, stakeholders, and other professionals is key, as is the ability to build relationships and collaborate across diverse sectors.

- Analytical and critical thinking: The ability to critically analyze and assess the impact of investments on society and the environment may be one of the most important skills for an impact investor. Often this is tested as part of interviews. Search online or ask your college about Financial Analyst Aptitude Tests and how to prepare for this – just a little bit of studying can give you a huge leg up!

- Knowledge of sustainable investment vehicles: Understanding the various sustainable investment options such as green bonds, impact funds, and social impact bonds should also be done in preparation before you start looking for a job. Free online sources such as articles like this one or even free classes offered in Khan Academy can also help you understand more about the specifics of sustainable finance.

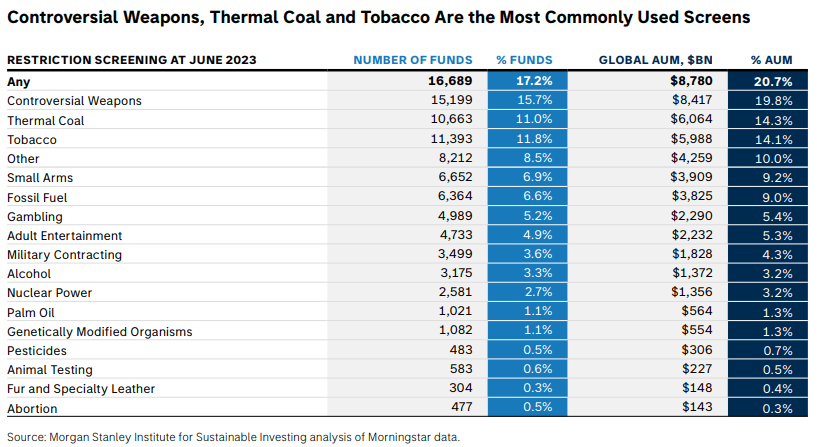

As the demand for sustainable finance and impact investing continues to grow, individuals with these specialized skills will be well-positioned to make a positive impact on the world while furthering their careers in finance. A pro tip is to stay up-to-date on relevant news such as the emerging SEC disclosure regulations and the EU’s Sustainable Finance Disclosure Regulation (SFDR) as well as news in the finance and ESG world. Reviewing overall trend reports such as the Morgan Stanley Institute for Sustainable Investing’s ‘Sustainable Reality’ series can help you understand more about where ESG investing is going, what’s popular, and what’s changing in this rapidly evolving field – for instance, did you know that controversial weapons, thermal coal, and tobacco are the most commonly used screens for impact funds as of mid-2023?

Summary

The field of sustainable finance and impact investing is rapidly growing, and it’s important to stay on top of all these changes. To find success in this field, you should keep yourself informed as to the latest news and regulations regarding sustainable finance. Subscribe to email newsletter, follow thought leaders on LinkedIn, do whatever fits your learning style! Even if you have a degree in sustainability or finance, taking a course specific to sustainable finance or impact investing can go a long way. In addition to giving you additional credentials, it can also help you understand what a job might require and what skills you might need to brush up on as well as what your strengths are.

Potential job roles in sustainable finance include a Sustainable Investment Analyst, an ESG Portfolio or Fund Manager, or an Impact Measurement and Reporting Specialist among many others. As impact investing continues to grow in importance, these professionals play a crucial role in making informed decisions that align with their organization’s mission and values, ultimately driving meaningful change in the world.