7 seconds. That is all the time you have to make a first impression with your CV. Recruiters have to sift through hundreds if not thousands of CVs and the competition for each opening is becoming fiercer. Back when I was an MBA student, we were told that only 1 in ~250 finance candidates ever makes it. Imagine my shock when I found out that the number is in 1 in >1000 now. I never thought that would be possible, but it is.

But my intention is not to deter candidates. There is a reason such competition exists and it is because graduates and young professionals still want to get into finance. It is still a great career for those who are willing to compete.

In addition to the higher CV volumes, another major trend has been the use of AI tools to pre-screen and filter resumes. While these tools are helpful for the companies, it can mean that a good candidate may get left out just because the CV was not writing optimally. This is something that we didn’t have to bother when I graduated B-school but things change and you have to change with them.

This is why I believe it is worthwhile for candidate to have their CVs written by professionals. Of course, you are still the one ultimately responsible for your CV, but a good resume writing service can better portray your skills and qualifications to recruiters and their automated systems.

What to look for in a Finance Resume Service?

Not all resume writing services are created equal. This is especially true for the banking and financial services industry where roles can be quite technical and the competition is like nothing else. Any service you use, must meet the following criteria:

- Experience with finance CVs – This is my top priority as BankersByDay is all about finance roles. I have looked at thousands of finance CVs over my career and I know what works and what doesn’t. I expect that same level of expertise from any service that I recommend.

- Should make your CV pop – As stated earlier, you only get a few seconds to impress the recruiter with your CV before they pick the next one from the massive (virtual) pile in front of them. There are certain tricks of the trade that can make your CV pop and these professionals know what those are.

- Optimised for ATS (Applicant Tracking Systems) – Because recruiters handle thousands of CVs nowadays, they use automated software called Applicant Tracking Systems and other nifty AI/ machine learning tools to help them out. These tools look for certain key characteristics so its best to let the professionals work their magic to optimise your CV for ATS systems. Millions of candidates get rejected by these programs so you need professionals with experience in dealing with such systems.

Based on these factors, here are my top recommendations. Note that I will only be giving the TOP recommendation in each category.

1. Find My Profession (Best Premium)

If you want the best of the best, this is it. Find my Professions is one of the highest rated and most helpful resume service providers out there. The catch is that they do charge more than the competition, but its almost always worth it if you are applying for a finance or banking role.

The service is focused on executives, senior management, CXOs etc, but they have all sorts of packages including one for entry level professionals. For the banking and finance industry where competition is fierce, I feel the extra edge is definitely needed and helpful.

They offer a number of packages differentiated by the seniority of the role you are targeting. Banking and Finance roles have a lot of competition, so it makes sense to add a little extra oomph to your CV and these guys will help you do just that.

The packages are slightly more expensive than competitors but you are paying for quality. The level of service should not give you anything to complain about though. They have experienced professionals in all industries so you are covered for any role you can think of. Their professional writers will guide you through the whole process.

The higher tier packages come complete with cover letter and LinkedIn profile and I can’t stress how important LinkedIn is nowadays. I don’t think I have ever hired anyone without looking at their LinkedIn profile. The LinkedIn service also optimizes your profile for search engines which means recruiters searching for candidates are more likely to find you.

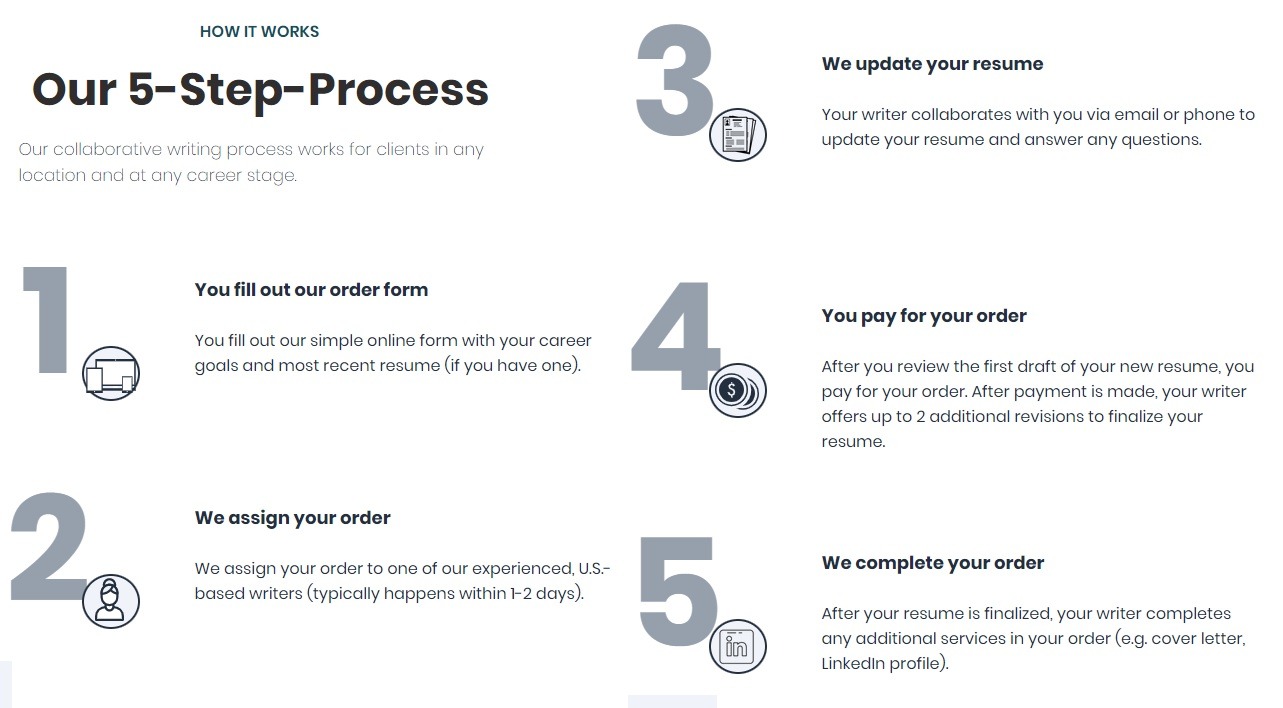

You get a one-on-one strategy session with your resume writer to discuss your career goals, expectation, current strategy etc. This goes a long way in helping the process of perfecting your CV for your dream job. There is also an excellent career coaching service and if you need a bit more guidance you should definitely look at that too.

2. TopStack Resume (Best mid-range)

If you are looking for a premium service that’s still affordable, look no further than Top Stack. They offer premium options with all the bells and whistles but without breaking the bank. You can talk to your resume writer via a phone call or email to communicate your unique requirements and preferences and you get your resume withing a week or two. What I liked about them was that the writers were friendly and responsive. You can bounce your ideas off of them and they will try and accommodate it into the draft CV and make edits in just a day or two.

The writers have experience with a variety of roles so its easier for them to detail your job experience in a more helpful manner. That’s the whole point of paying for these services and these writers just nail it.

3. TopResume (Value for Money)

TopResume is one of the larger Resume Writing services with a wide variety of experience in various sectors and role types. They match each candidate to a resume professional resume writer based on their industry experience to ensure best results. The packages are well priced and the higher level packages include LinkedIn and cover letter writing as per your needs. I highly recommend using the LinkedIn service as almost all recruiters tend to look at it nowadays. This is especially true in the finance sector where networking is still King and LinkedIn is the best networking tool outside of interacting with people in your office.

The Resumes are keyword optimized meaning they do well in automated Application Tracking Systems that some larger companies use. Given the sheer volume of CV’s received, this becomes especially important. I have hired plenty of analysts and it wasn’t uncommon for me to receive thousand plus CVs for a single role so I often relied on such software tools to do the initial screening. These automated systems can be a bit finnicky though and these professional resume writers know how to work around them so that you dont lose out because of a software glitch.

The service is very competitively priced and offers tremendous value at that price point which makes it a solid recommendation overall.

4. ZipJob Resume Writing Service (Best Entry level)

ZipJob is a great option and the ideal entry point for those having their first crack at a resume writing service. They offer several beginner friendly packages and services that should suit most young professionals. I looked at close to a dozen services – some good, some really bad – but this is a solid option that I would recommend based on my experience in the banking industry.

The packages are competitively priced which makes them attractive to those gunning for entry level roles. I would advise interns and analysts to go for the entry level packages while associates and above should go for the professional/ premium packages. Even the premium packages are very reasonably priced so that makes the decision an even easier one.

Their resume professionals have plenty of experience dealing with finance resumes which is important as banking resumes need a special flair. CVs are optimised to be read by Applicant Tracking Systems that are used by many large financial institutions.

The cover letter is included as part of the Fast Track package if you need that. I do recommend you get the LinkedIn profile done as well (premium package) because it is definitely something that everyone looks at nowadays. I know I do! LinkedIn also helps tremendously with networking.

Overall, this service ticks all of the boxes and should be your first stop if you are looking to have your CV done professionally.

Some parting tips

Your CV is one of the most important documents that you will work on in the early part of your career. It will create the foundation on which you build your career. A major issue these days is that automated Applicant Tracking Systems can get confused and reject your CV for no reason. I always knew this was the case but was surprised by its scale as this article claims that millions of candidates are erroneously rejected by automated software. That explains why so many people never get a call back despite being suitable for the role they are applying to.

Given all these facts, and the enormous competition that exists for the best jobs, my advice would be to not skimp on your Resume. Invest the time necessary to get it as close to perfect as possible and don’t hesitate to reach out to professionals who know how to work around automated systems.

Related Articles

- Finance Internship Guide

- List of Finance Careers

- FinTech Careers

- Best Leadership Courses

- Business Writing