1. What is a Credit Analyst?

A Credit Analyst is a financial professional who assess the credit-worthiness of a client (corporate or individual) based on financial or other relevant data. The objective of this analysis is to determine how much risk the bank can take on that particular client.

Credit Analysts are the guardians to the vaults of a Bank. Their primary role is to gather all the relevant information about a prospective client, compile it into a standard, easy to digest format and then present it to the management and credit approvers who will then make the final assessment on whether to lend money or not.

2. Job Description

The only job of a credit analyst is to manage the credit risk of all the bank clients that have been assigned to them. Credit risk essentially is the risk of default on any sort of loan or other outstanding liabilities by a client. The credit analyst is the one who has to ascertain the capacity of the client to repay the loan. This is a six-step process:

(Note: The credit analyst is not the one making the ultimate lending decisions. That is done by a separate team or even a senior committee in order to avoid conflict of interest. Credit analysts just put the most logical case forward to these decision makers.)

2.1. Information Collection

- The Credit Analyst must collect all available information on the client and its industry. This includes things like financial statements, news reports, quarterly sales data.

- Credit Analysts also have access to the client directly and can (and should) ask for ad-hoc data that is more in-depth or recent. For example, they can ask the client to break down their sales data by individual products or services in order to analyze how disruption in one service might affect that company.

- Data on competitors and the wider industry is also collected as no company operates in a vacuum.

- The credit analyst must work closely with the relation/ coverage team to get this information from the client.

2.2. Information Analysis

- This is the most time-consuming process and requires processing and analyzing all collected information into credit memorandums or proposals.

- Ratios are analyzed, strengths and weaknesses listed, projections may be done, simulations are run and so on.

- This not only includes quantitative information like leverages, sales momentum, market share, interest coverage etc. but also qualitative information like management overview, brand quality and so on.

- This is also the phase where the credit analyst will analyze individual product exposures. For example, the client may only be issued a direct credit line of USD 1 billion while another billion may be made available to the client in the form of bank guarantees and 500 million in the form of currency derivatives and such.

2.3. Risk Identification

- Risk identification is what credit analysts to best. You need to look at all the processed information and use your judgement to identify and list ALL risks. For large corporate clients, this can easily run into several pages.

- For example, if your client is a steel mill there may be risks of tariffs, environmental issues causing reputational risk, possible dumping in the local market from Chinese manufacturers driving down prices, risk or reduced demand due to auto-sector slump, and thousands of other things. You have to then account for each of these factors in the next step.

2.4. Risk Mitigation

- All risks cannot be eliminated, but they can be reduced or mitigated. The credit analyst is assisted by the relationship team in this task who also suggest ways to minimize all identified risks.

- Taking our previous example of a steel mill further – the client may decide to broaden/ strengthen its environmental policies, or decide to produce a much higher grade steel that cheap manufacturers can’t produce yet or diversify its client based so that it is not susceptible to excessive buyer risk etc.

- The bank can also mitigate risks from its part by asking for collateral against any exposure, reducing the allocation of more risky products, insisting on third party guarantees (from the steel mills parent company for example) and so on.

3.5. Credit Covenants

- Credit covenants are essentially conditions placed on the client as part of the risk mitigation process.

- This includes things like – no sales drop of more than 5% per quarter, no increase in leverage from current levels, no drop-in profitability etc. As soon as any of these are breached, a review is immediately triggered.

2.6. Monitoring

- Credit analysts are ultimately responsible for tracking all these credit covenants in combination with the client coverage teams.

- You also must bring attention to any adverse news that may impact one of the bank’s clients. You have to proactive and really track your industry and make sure the clients or the coverage teams tell you all material information.

- Annual reviews are also part of the monitoring process where all numbers and exposures are revaluated based on fresh data.

3. Qualifications and Skills

- People management – You need to get hold of a LOT of information which might not be readily available. You would need to call the client multiple times and ask for all sorts of data (granular information which may not be published publicly by the company). Eventually, you will get better at knowing what all you need and get it right at the beginning, but you will still be going back to the client often.

- Industry knowledge – No company exists in a vacuum. Things that are happening in a sector affect all companies in that sector. Having a good idea about the entire industry is how you determine whether your client company is doing better or worse than its competitors and whether it is good idea to lend to them.

- Client knowledge – Knowing the industry and having the general credit skill set is good, but having a deep knowledge about a client’s operations is what separates good credit analysts from the great ones. This gets built automatically over time but some analysts are always better than others.

- Analytical mindset – Being a credit analyst will require you to have decent reasoning and math skills. When you first sit for an interview, these are the skills that will most likely be tested. Not all information is available and not all dots are connected by default. A good credit analyst should be able to spot patterns and make logical conclusions based on available data.

- Credit skills – Once you have all the information, you still have to analyze it. Keep in mind that this analysis is not to convince yourself, but the actual decision makers in the bank that the client will not run away with the bank’s money. You have to look at the strength of their balance sheets, their growth prospects, their ability to repay, their market positions and dozens of other things. This might sound overwhelming, but this is actually the part that is much easier to learn as long as you have an aptitude towards logical reasoning.

- Being confident and convincing – Not everything is objectively measured. Often times, you would have to rely on your own powers of persuasion to get a subjective point across. For example, a 0.5% change in some metric might be a big deal to someone but might just a be too small to bother for others. It’s up to the credit analyst to convince the credit approver about why X matters and Y doesn’t.

- Accuracy and attention to detail – Stakes are generally high in corporate banking as you are dealing with massive amounts of money. Mistakes can lead to significant blow-back, so people who are careless or in a hurry generally don’t do so well. This is a role where consistency is more important than outright brilliance.

- A clear thought process – Everybody makes mistakes. At the end of the day what is important is that you have a clear thought process behind every decision and every conclusion that you make. If you do mess up (just like everyone else does), your superiors and others will support you as long as you can convince them that you did the right and rational thing based on the formation you had. You should always know why you are doing things a certain way.

- Academic Qualifications – You need to be a graduate preferably in a mathematical field like finance, accounting or business. This is a starting career so you might get away with zero work experience but if you have done anything similar, even 1-2 years of experience would usually be considered more than enough.

Relationship Skills

Technical Skills

Leadership Skills

Industry Experience and Market Awareness

4. How to Become a Credit Analyst?

All the skills mentioned above are “nice to have”, but the single most important factor that recruiters would be looking for is your technical aptitude towards mathematical analysis and logical reasoning. Demonstrating other skills would certainly not hurt, but your ability to crunch numbers and apply logic is what is primarily required. Consistency, discipline and accuracy would probably be the next set of skills that need to be demonstrated both in your CV and throughout the interview process.

The best way to demonstrate these skills is to have high grades in a math heavy course like accounting, finance, business or even engineering. There are also certain certifications like GARP’s Financial Risk Management that would really add value to any risk related profession including credit analysis. It is by no means necessary, but if you are looking to break into a top tier firm and stand above the crowd, an FRM certification would most definitely help.

Moving on to soft skills, there is nothing wrong if your resume displays a lot of leadership traits but bear in mind that this is a supporting role where you are helping others to make decisions. I would want to hire a credit analyst who is hungry to learn the tools of his trade so that he can develop a comprehensive understanding of banking products and lending principles.

4.1. Credit Analyst Certifications

I can highly recommend the following course: Credit Risk Analysis Professional Certificate from the New York Institute of Finance (NYIF). Its online, takes about 35 hours to complete and comes complete with an official certification from NYIF.

I spent a lot of time analyzing the curriculum of several courses and this one is by far the best fit from a practical standpoint for a Credit Analyst role. Participants who pass the examination receive a Credit Risk Analysis Professional Certificate from the New York Institute of Finance. This offers, in my opinion, the best alternative to having on-the-job experience for credit analysis. You get some “desk ready” practical knowledge and a solid brand to add to your CV.

The Certified Banking & Credit Analyst (CBCA) from Corporate Finance Institute is another great option. It is also laser focused on credit analysis from the perspective of corporate and institutional banking.

Here is my detailed review of these and other courses:

Best Credit Analysis Courses ranked by Bankers (2022)

4.2. CV Building for Credit Analyst Roles

Any credit experience should obviously be highlighted front and centre. Any other risk experience would also be welcome, even if it not directly credit risk related. I highly recommenced one of the above courses to give yourself an extra personal branding boost and highlight your expertise.

If you still need help with your CV though, you can make use of one of these professional services:

Best Resume Writing & Review Services for Investment Banking & Finance ranked by Bankers

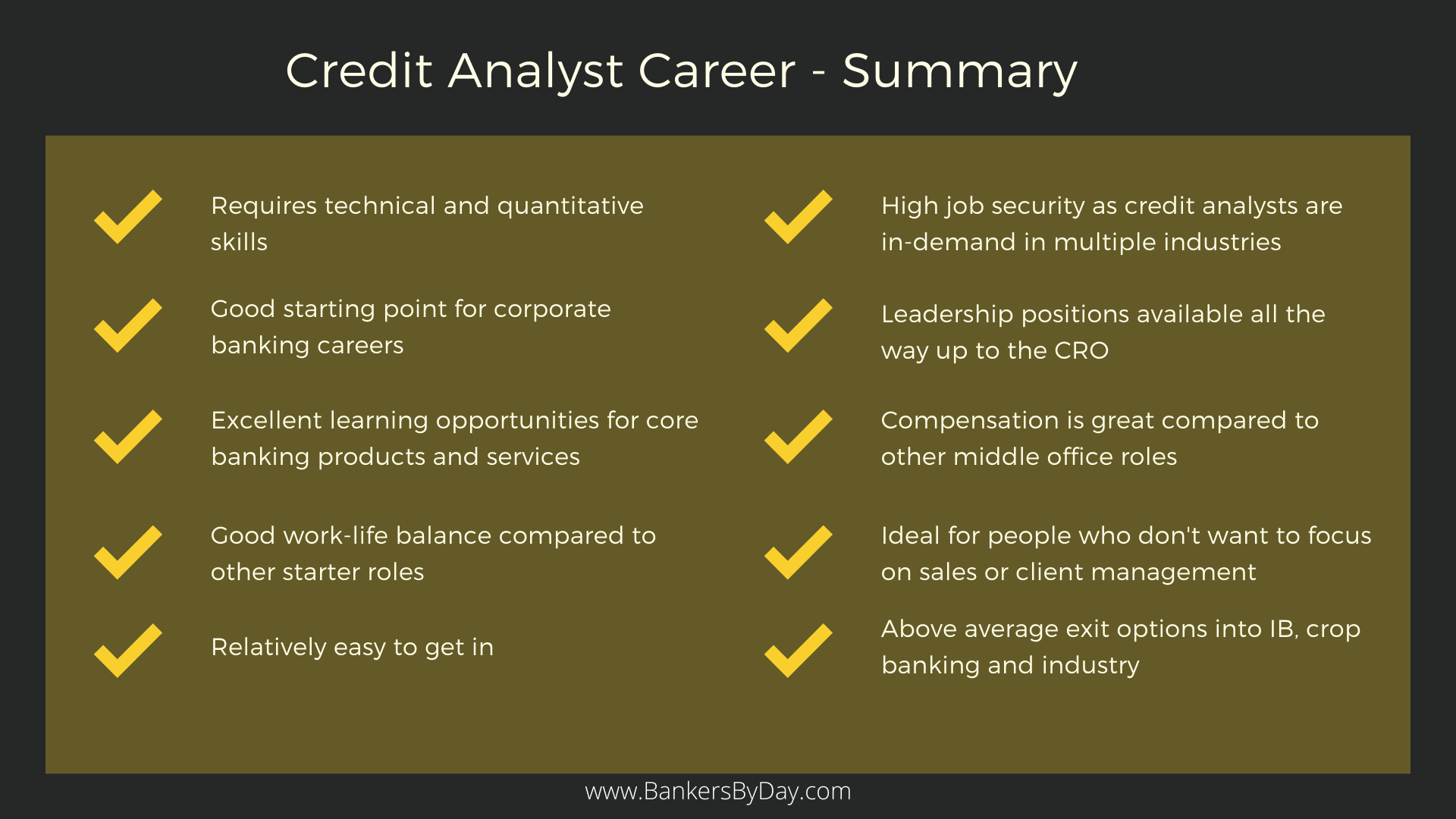

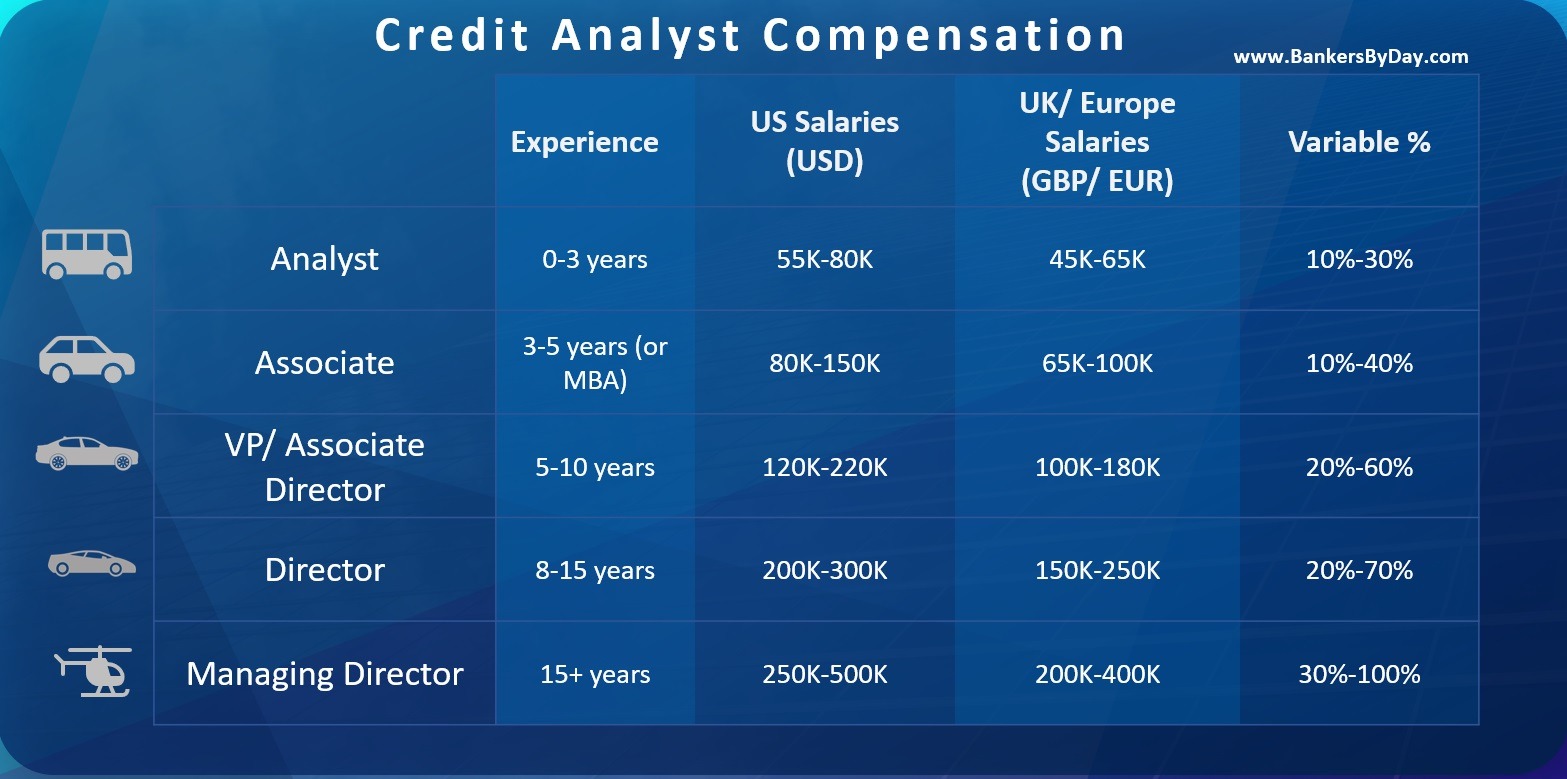

5. Salary and Bonus

Salaries vary greatly from country to country and also based on your total work experience. Banking salaries are highest in financial capitals like New York and London followed by other hubs like Frankfurt, Paris, Honk Kong, Singapore and various US cities.

A first-year credit analyst might earn around USD 80K in the US or EUR 60K in Europe. There would likely be a variable component above this of around 30% which should go up over time as you start getting better at what you do. Also keep in mind that this is just your first-year salary, it will increase appreciably with experience. The first 1-2 years are when you are just focusing on learning your craft. It’s usually after after three years that you start becoming a valuable resource who can be relied upon. Once you have some years of experience under your belt and a good reputation, you would easily be able to double your starting pay in short order.

These salary numbers also depend upon the bank you are working for and the sort of clients you are handling. A small regional bank would pay less than a global banking behemoth. Its not unheard of to be offered USD 100K-120K by a top tier bank for handling their Global Fortune 500 clients. But such roles are rarer and I really want to stress that this depends on the bank and location.

5.1. Relative Salary Comparisons

A more reliable way to look at salaries is by way of a relative comparison to other banking roles. A corporate banking credit analyst would usually earn more than a retail banker but less than a corporate banking relationship manager or someone in investment banking. Credit analysts are still a cost center for the bank, but they are generously paid when compared with most of their mid-office brethren.

Credit risk assessment is one of the most important skills in banking and it will help you out throughout your career. Credit analysts serve as the guardians of the Bank’s wealth. Hence, they are always thought of as technically competent. It is also important to mention here that many Bank’s would require their corporate banking sales people to have had some sort of Credit experience beforehand. A stint of 3-5 years as a Credit Analyst would really bolster your chances to move to the front-end as long as you meet the other skill requirements.

6. A Normal Day as a Credit Analyst

As a credit analyst, you spend your days either looking at new clients or existing ones.

6.1. Preparing new proposals for lending

Depending on the size of your clients, you might handle anything from 5 to 500 new credit proposals each year. If you are looking at a massive corporation where the overall relationship with the bank is worth billions – you would likely not have to manage more than 10 such clients a year. But if you are looking at small and medium clients with more modest exposures, you can expect to handle a lot more volume.

The initial data is sent to you by the front-end teams (sales/ relationship guys). They will really ride you hard to get the proposals done as quickly as possible and (at some banks) you might even have an indirect reporting to them! So you really straddle the rift between the business originators who want every single proposal to get through and the risk approvers who have to make sure the bank doesn’t go belly up doing just that.

6.2. Reviewing existing clients

This is the process of continuous monitoring of various credit thresholds for your existing clients. Some banks have separate teams for new clients and a different team for existing ones but that is not always the case. The reason for this is continuity – if you had the loan approved, you are in the best position to monitor it in the future. Keep in mind that some of these loans are revolving so they never really expire. You just monitor them continuously and keep updating the financial performance year after year. Most banks would do a thorough annual credit review for each client.

Other than the annual reviews, you just monitor the various credit conditions. For example, any dip in sales or any increase in financial leverage beyond a predefined level might require you, as a credit analyst, to trigger an immediate review of the credit risk. As you can imagine, the bigger the exposure, the more sensitive these triggers are.

6.3. Learn to love your desk!

You might have figured by now that this is not really a role that requires a lot of travel. You usually sit at your desk and look at various documents like client financials, industry news, or the proposals that you are working on. In case you are working on some new proposal, you might need to have a lot of calls with the client to get the info that you need. But you will be assisted by the relationship team in this case. You do get to meet clients at senior level positions though.

Your primary source of information would be the client’s financials – the Balance Sheet, Profit & Loss account, Cash Flow Statements, Auditor’s Comments, Management Notes etc. You would be expected to pore over every bit of information available, catalogue it and assess it. Lending decisions are made based on the information which you provide, so accuracy and attention to detail are of paramount importance.

6.4. Work Hours

Credit Analysts have it pretty good when it comes to work-life balance. Your job is almost a 9-to-6 and weekly numbers tend to be around 45 hours. It can get a bit hectic towards the end of the month as you might have deadlines to close a couple of credit reviews and cases. During such crunch time, expect to be closer to 60 hours a week but that is really up-to how well you manage your work load for the rest of the month.

There is also some difference based on the type of clients you are handling. The biggest clients have a lot of products and service and therefore a lot more analysis goes into their credit analysis. Expect to spend more time if you handle such clients but it is more than offset by the added excitement and significantly higher compensation.

7. Career Path and Progression

Credit Analysts have two main career paths available to them. They can choose to stick to their field or leverage their credit skills to get into other related roles.

7.1. Sticking to credit risk

The most common option is just sticking to your field and growing organically, although it might be slower in terms of salary growth. Over time, you would be handling larger and more important clients which means more responsibilities and hence more rewards.

There is definitely enough demand and scope for growth in credit risk departments across banks and even non-banking institutions. 8-10 years down the line you might be eligible to take up a team leader role and manage a team of junior credit analysts. The ultimate target for someone like this might be the CRO or Chief Risk Officer position or is equivalent.

7.2. Relationship/ sales roles

The credit risk department is not a revenue generator and that is reflected in the bonuses. That’s not to say that credit risk is not an ideal field for someone who has no desire to be in sales. But a lot many credit analysts use it as a launch pad to learn about banking products and then move to a front end sales role.

The most financially rewarding option might be to eventually graduate to become a relationship/ coverage manger for corporate banking products. As a credit analyst with years of poring over client’s financials and other data, you would probably be in the best position to know about all the risks and rewards of funding a client. The catch here is obviously that you would be moving to a significantly different role and would need the skills that an RM is expected to possess. It is important to be a people person, be very assertive and an extrovert and be able to think quickly and muster resources to get things done.

7.3. From Credit Analysis to Investment Banking

Finally, there also exists the possibility of moving to other fields where technical financial expertise is valued. It could be anything from investment banking to debt capital markets to even risk consulting. Such moves are rarer compared to the two main paths already mentioned, but if you really want to make the switch and you are good enough, it is certainly doable.

Look at the overlap in skill requirements and experience to see what is possible. With credit risk skills, you can be a good fit for DCM or rating agencies, but not so much for ECM. Similarly, if you have a lot of complex modeling experience, then leveraged finance is within reach and same for project finance for those who have worked on funding a lot of infra or industrial projects.