Financial Modeling is an integral part of what you do in finance in general and banking in particular. In fact, it might be all you do for the first few years of your career. Setting yourself apart during the recruitment or internship process is crucial given the severe disparity between available roles and candidate volume. As always, a good academic pedigree will go a long way, but there are other ways to boost your chances.

All the courses in this list will help you learn financial modeling, but they each offer something extra as well. That extra something might be brand value or having a classroom experience or perhaps real-world case studies. Hopefully, this article can help you pick the one that you need to make it in finance.

1. Wall Street Prep’s Premium Package

Course Review

Financial modelling is a core skill that you will need to master for most financial roles. Its so fundamental to success early on in your career, that it should be the first thing to focus on and become an expert right away. Whenever anyone at your firm even thinks about a financial model, your name should pop into their heads at a subconscious level.

I realize that all sounds a bit excessive, but I just want to stress how fundamental this skill is to your finance career. Especially early on when you are preparing for the selection process or as an analyst. And this is the package that you want if you want to go full beast mode with financial modelling.

Modelling is not an easy skill to master. Sure, its easy enough to learn the basics but that is not going to get you far. There an infinite number of nuances, lots of little tricks and best practices to learn. These are not things you an learn in an academic course, you need someone with practical industry experience to teach you all of this. That is what makes WSP’s premium package ideal for this purpose. Its been specifically built with one singular purpose – to make you hit the ground running on day 1.

There is a lot of solid content here. From financial statement modelling to DCF modelling, from M&A modelling to trading comps modelling and from transaction comps modelling to LBO modelling. Almost all financial courses, including university coursework, cover some amount of modelling but WSP is delivering things from a more practical, real industry perspective. Its less of academic theory and more of I-am-sitting-at-my-desk-and-need-to-make-this model-by-end-of-day.

The practical experience of the authors shines through in most of the videos and those are the little things that you should really grab on to while you take this course. After a decade and half in finance, there are certain things that my brain automatically filters out as fluff and certain things I know are important. And I can tell you, there is not a lot of fluff in this course. They are indeed dropping gold nuggets most of the time.

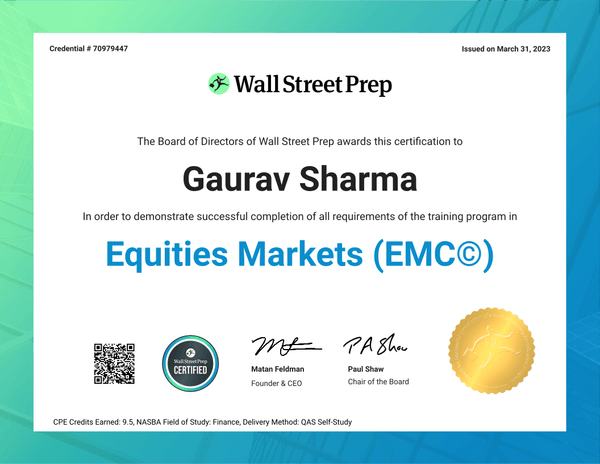

YOU GET A NICE CERTIFICATE THAT YOU CAN EMBED TO YOUR LINKEDIN PROFILE OR ANYWHERE ELSE

At the end of the day, what really sets this course apart is that it makes you feel like an industry insider. Part of that is due to the highly practical nature of the course content, but part of that also has to do with the course’s reputation in the industry. This is the course that many investment banks choose to train their new hires to get them up to speed. So there is a decent chance that the person interviewing you took this course at some point in their lives or at least knows about how good it is.

Click here and use code BANKERS for a 15% discount on this course!

Summary

| Duration | Around 35-45 hours |

| Format | Fully online, on-demand |

| Level | Intermediate |

2. Certified Financial Modeling & Valuation Analyst (FMVA) from CFI

Course Review

Banking and Finance are by no means easy-to-get roles. You need something to stand out and the FMVA offers the best brand recognition and CV value, in my opinion, when it comes to Financial Modeling. Its offered by the Corporate Finance Institute which has built a name for itself with this popular certification program.

The curriculum is divided into a series of optional, required and elective courses. This modular structure is something that I really like as it means you can pick and choose the courses you want based on your skill level and experience. Need an intro to Corporate Finance? Take the optional Corporate Finance prep course. Already know Excel? Skip that elective. Such options are always nice.

The bulk of the electives are related to financial modeling and Excel. You learn everything you need to learn to prepare for a modeling interview. You start with the foundational courses which includes business valuation modeling, budgeting and forecasting, scenario and sensitivity analysis, power point and pitchbooks etc.

Then you move on to advanced topics like sector specific modeling like mining financial modeling, LBO modelling, M&A modeling, renewable energy modeling etc. You don’t have to take all of these – just pick the ones you actually need!

There are plenty of case studies to sink your teeth into and the focus on real world practical skills instead of just academic understanding is really welcome. That should be expected as the course has been made by our fellow bankers with plenty of experience in the field.

Click here and use code BBD10 for 10% off!

Summary

| Duration | 100-150 hours |

| Format | Fully online, on-demand |

| Level | Intermediate |

3. The Modeler Course from Financial Edge

(Note: Use code BBD25 for 25% off at Financial Edge)

Course Review

Financial Edge is an elite training provider that provides in-house training to bankers at some of the worlds top investment banks. These are the people that investment banks turn to when they need to train their people. That should give you a sense as to the quality they offer and the reputation they have built. The best part is that because of their name recognition in the finance world, a certification from Financial Edge is well-recognized in the industry and that alone can open up a lot of doors for you.

Financial Edge is an elite training provider that provides in-house training to bankers at some of the worlds top investment banks. These are the people that investment banks turn to when they need to train their people. That should give you a sense as to the quality they offer and the reputation they have built. The best part is that because of their name recognition in the finance world, a certification from Financial Edge is well-recognized in the industry and that alone can open up a lot of doors for you.

The course material is well design and structured with plenty of videos to explain the content. There are over 50 practical exercises for you to sink your teeth into. That should be more than enough to give you the confidence you need to hack away at those models in the real world. It is this practical focus that makes this course so highly recommended. Academic theory is good, but real world practice is better. You have to complete an online quiz to complete each module and earn your certification. You can use this certification to spruce up your LinkedIn profile and showcase your skills to potential recruiters or your boss.

Moving on tot he course content itself, there is plenty of goodness here to go around. You start off with an introduction to modeling with basic stuff like income statement, balance sheet and cash flow analysis, and even formatting and preparing a pitch book. After some practical exercises you move on to more advanced modeling with three financial statements. calculating schedules, balance the balance sheet, and several Excel tricks that help you better prepare a model. The focus here is clearly to turn you into a pro with modeling in Excel and that’s always a good thing.

There are more advanced topics like cash sweeps, revolvers, circularities, long term debt, and even auditing your model and error checking. You also need to be able to work on or understand other analyst’s models and so best practices need to be followed and understood.

Click here and use code BBD25 for a 25% discount on all Financial Edge courses!

Summary

| Duration | Around 10 hours |

| Format | Fully online, on-demand |

| Level | Intermediate |

4. Business and Financial Modeling from Wharton

Course Review

This course will get you desk ready for any Financial Modeling role. The course is suitable for beginners as it lays the foundations before getting into the thick of things. It provides a smooth learning slope and takes it time to get the concepts across.

Wharton has brought out the big guns with this course and it carries some serious brand value. You get a completion certificate that it will add some serious pop to both your CV and LinkedIn profile. Yes, that is important enough to be mentioned right at the top of this list.

The course quality itself is excellent and the modules are delivered by top Wharton faculty. There is indeed a focus on finance, and it covers everything from spreadsheet modeling, investment analysis and company valuation to forecasting, decision making and scenario analysis.

Concepts covered include spreadsheets functionalities, building models, scenario testing, modeling risk, forecasting, decision making using these models and a capstone project to top it all off.

The course is excellent value because you are getting quite a lot at a really competitive price.

Summary

| Duration | 40-50 hours |

| Format | Fully online, on-demand |

| Level | Beginner to Intermediate |

5. Financial Modeling Professional Certificate from NYIF

Course Review

A more advanced course that is meant for investment banking analysts, private equity or hedge funds professionals.

This is one of the best and most comprehensive courses you will find on financial modeling. The New York Institute of Finance produces very high-quality courses for finance professionals, and this one really belongs at the top of the pile.

You get hands-on guidance from industry experts in a virtual/ physical classroom environment. This really adds to the overall learning experience in my opinion. Probably because having other students around you (even if via a video link) makes learners more competitive and committed.

You start off an advanced excel course followed by modeling and then three full days spent on valuations. Its pretty comprehensive and should be more than enough for any analyst looking to get into finance or making a lateral move.

Perhaps that is the best part about this course – its focus on desk ready skills so that you can hit the ground running. Everything taught has a practical urgency to it. Which is not surprising considering NYIF has been teaching bankers and traders for almost a century now.

Summary

| Duration | 5 days |

| Format | Fully online or virtual classroom |

| Level | Advanced |

6. Financial Modelling and Analysis from the University of Cape Town

Course Review

This course has been designed for junior to mid level finance professionals and analysts. Its a combination of accounting, finance, business metrics and spreadsheet skills to help you critically analyze a business strategy over both short and long terms.

You will learn to use Excel effectively for financial modeling including several advanced functions. You will deal with accounting statements including relationships between them, how to build them, what ratios to look at, how to forecast for future periods, how to use historical data correctly, how to interpret various numbers, how to resolve ambiguities.

I highly recommend downloading the course brochure to get a feel for what you need to learn when it comes to financial modeling. In addition to what I have already mentioned, you also focus on sensitivity and scenario analysis, modeling businesses, decision making , valuation and so on. Almost everything you need to know as a financial modeler is covered here in some shape or form.

Click here and use code GS-AF-BBD15 for a 15% discount on this course!

Summary

| Duration | 8 weeks (with 8-10 hours per week) |

| Format | Fully online, on-demand |

| Level | Intermediate |

7. Beginner to Pro in Excel: Financial Modeling and Valuation

Udemy has several nice, smaller courses that can help you fill the gaps in your understanding of financial modeling. These are smaller, more focused courses that will help you focus on specific areas.

Beginner to Pro in Excel: Financial Modeling and Valuation – A short introductory course that covers both Excel and the fundamentals of financial modeling. The course covers most of the fundamentals rather well and there are several resources available like videos, charts, downloadable guides etc.

At the end of the course, you should be able to have a firm grasp on how to get almost anything related to finance done in Excel. Well suited for beginners.

The Complete Financial Analyst Course at Udemy – This course is ideal for financial analysts and encapsulates all you need to know about Excel, budgeting, cash flow and other activities that a financial analyst performs.

Financial Modeling: Build a Complete DCF Valuation Model – Goes into a bit more depth about the Discounted Cash Flow model. Use this to supplement your understanding of DCF models or get a bit of practice. DCF valuation is an important skill for corporate finance or investment banking interviews and this gives you a bit of extra hands-on practice with it. I feel its worth the time investment.

Financial Modeling for Startups & Small Businesses – Startup valuation is a whole different ball game. You need to know this stuff as this is what things are trending towards. The differences between the valuation methodology of mature businesses vs startups is a popular theme in finance interviews. Learning this could give you a key advantage as this topic is still not taught well in most business or finance programs.

8. Excel and VBA Programming for Finance from NYIF

Course Review

You can’t be a good financial modeler if your Excel and VBA programming game is not on point. This is equally important in Sales & Trading as well as investment banking roles. As an analyst, you’ll be doing a lot of modeling.

This is an intermediate level course meant for more advanced learners or those applying to more quantitative roles within finance. You learn more advanced functions as well as new tricks to help you get your modeling done faster.

This course teaches you everything from advanced excel functions and VBA programming to data analysis and using the Bloomberg terminal. There is significant focus on finance specific applications like bond yield calculations or creating a Black Scholes option price calculating program. like It’s a meaty 3 day course and it will get you desk ready.

Perhaps that is the best part about this course – its focus on desk ready skills so that you can hit the ground running. Everything taught has a practical urgency to it. Which is not surprising considering NYIF has been teaching bankers and traders for almost a century now.

Summary

| Duration | 5 days |

| Format | Fully online or virtual classroom |

| Level | Advanced |

9. Finance & Quantitative Modeling for Analysts from Wharton

Course Review

This course shares some material from the other Wharton Course on this list but this one is targeted towards business analysts in general who have to perform financial modeling as part of their day-to-day.

In addition to working with spreadsheets, students are also taught basic financial terminology and the fundamentals of corporate finance by Wharton faculty. Quality wise, this is top-notch.

The course starts off by laying the foundation of quantitative modeling and spreadsheets. In the second half of the course, you focus on financial concepts like cash reporting, income statements, forecasting, time value of money, the risk-return tradeoff, cost of capital, interest rates, retirement savings, mortgage financing, capital budgeting, asset valuation, discounted cash flow (DCF) analysis, net present value, internal rate of return, hurdle rate, payback period and so on.

Wharton is a solid brand to have yon your Resume. Think of this course as something you are taught in the first year of a MBA degree as the course and difficulty level is very similar to that.

Summary

| Duration | 30 hours |

| Format | Fully online, on-demand |

| Level | Beginner to Intermediate |

What to look for in a Financial Modeling course/ certification?

Brand Value for CV Building – These Certifications have been hand-picked to provide you with the maximum CV boosting potential. Its a competitive job market and you need every edge you can get. HR and hiring managers have to sift through thousands of CVs and they are looking for things that pop. Big brands, stellar grades etc. do that and you need to make best use of any such opportunities that may be presented to you.

Real-world Learning – Companies expect you to hit the ground running on Day 1. Which is why I look for plenty of real world case studies and practical assignments when picking courses for these lists. This will also give you the confidence you need to do well in interviews and the rest of the selection process which always revolves around practical applications of theoretical concepts.

Niche specific – Not every course is suitable for everyone. Some courses here might be better suited for corporate finance analysts while others are better for investment bankers. I will highlight these differences where possible to allow you to pick the one that you need for the career path that you have chosen. There are also some beginner courses that are suitable for everyone and should serve as a solid stepping stone for anyone interested in a career in banking or finance.

The courses have been ranked based on the above criteria. The aim is to allow finance professionals better prepare for the hiring process including CV building with strong brands, interview preparation and hitting the ground running on Day 1 of your internship/ job.