1. What is DCM (Debt Capital Markets)?

Debt and Equity are the primary sources of capital for corporations. Debt is cheaper and interest payments are tax deductible which makes it an attractive option (when used in moderation) to fund business activities. Which is why corporations of all sizes, even the cash rich ones, usually have a debt component on their balance sheets.

Debt may be accessed in the form of bank loans which are handled by normal corporate and commercial banking teams. When debt is instead raised in the form of corporate or government bonds, that is when the DCM teams get involved.

2. DCM Job Description

The Debt Capital Markets team helps their clients secure funds for acquisitions, special projects or refinancing and restructuring existing debt at a lower cost. They help the client access a global pool of investors who would be willing to invest in such opportunities. There are several aspects to the job:

2.1. Pitches

This is going to be a big part of the job, especially for the first few years of your career. Detailed analysis and catchy presentations are what it’s all about in the beginning. The focus on financial modeling is a bit less than what you would do in M&A or even Equity Capital Markets (ECM). You focus more on structuring, yield curves, fixed/floating coupons, collateral, assumptions about interest rates and other such Fixed Income stuff.

2.2. Deal Execution

Execution involves negotiating the terms of the deal with the client and liaising with dozens of internal teams to get the paperwork done. This means onboarding, document reviews and client servicing for the duration of the deal. Third parties may be involved in due diligence and it will fall to you to coordinate with them.

You better be in love with making memoranda because you’ll be doing a lot of it in DCM. Most of the deals are pretty straightforward but sometimes might involve use of exotic instruments. Don’t worry, you would have plenty of time to learn about all of the finer intricacies within the first few years on the job itself.

2.3. Syndication

The syndication teams within DCM ensure that the issued bonds move smoothly to the secondary markets. It’s a whole different beast in terms of what you want to achieve, but in terms of what you handle (fixed income securities), it is pretty much the same. Syndication professionals form the bridge between the origination teams which are responsible for structuring and execution and the secondary market where these bonds are eventually sold.

2.4. Marketing

DCM Associates may spend some time updating and looking at bond databases and liability management transactions in their sectors or geographies. This information, coupled with market and regulatory updates, may be used for marketing purposes to aid in the origination efforts of the team.

Additionally, deal pipelines, investor analysis, market updates and deal reviews etc. may need to be shared with internal teams.

3. Qualifications & Skills

Fixed Income Expertise – This is your bread and butter, so you better know everything there is to know about Fixed Income Securities.

The first part of this is the technical knowledge of how fixed income securities are priced and traded. Yield curves, convexity, duration, structured and collateralized debt securities, derivatives like swaps and essentially just memorizing Fabozzi’s Handbook from cover to cover.

The second part of this is everything that is NOT in the books. Market information, deal histories, who the players are, what is happening where and who is doing what and why. You essentially need to have your ears firmly glued to the ground.

Ability to add value in a tough market – Most DCM clients are large multibillion-dollar global conglomerates or even government entities which issue investment-grade bonds. These clients will usually have experienced teams of professionals who already know what they’re doing. This means that in order to add value you’d have to bring something extra to the table.

You have to think of ways to save the client money by restructuring or refinancing their debt. Or perhaps how investing in certain credit derivatives might help them minimize risks or de-leverage their balance sheets and so on.

Creating solutions – The best work in DCM is when a client comes to you with a unique problem requiring a bespoke solution. This is where all your experience, knowledge and contacts come into the picture. These types of deals are also the ones that yield the most revenue because it is not a problem that just anyone can solve easily. This is where you really build a reputation and what separates a good banker from the greats.

Negotiation skills – while negotiation skills come in handy in almost any front-end sales roles, negotiation forms a bigger part of your deal cycle in DCM as compared to other roles. The service that you offer to clients is usually differentiated based on price because competing banks can match whatever other advantages that you bring to the table.

Legal expertise – There is a considerable amount of legal jousting and documentation that finds its way into a DCM transaction. While you will have internal legal teams vetting the documents for you, the negotiation of these terms with the client would still need to be done by you. Over time, you will likely become a legal expert yourself and would be able to predict what the legal teams internally and at the client’s side want and expect from the other side.

Sectoral experience – Depending on the size of a bank, it might have separate teams covering corporate bonds, high yield bonds, government, public sector and munis and so on. Financial institutions account for almost half of all debt issuance so there’s a good chance you would be working for a team that focuses exclusively on such institutions.

Deal experience – Nothing prepares you for the job like some hands-on experience. There are big deals that happen in DCM and having worked on some greatly increases your value in the eyes of a recruiter.

Origination and relationship management (senior levels) – You don’t necessarily need to keep hunting for new clients in DCM since your existing clients will likely have a stable flow of business being thrown your way. Given the repeat nature of business in DCM, maintaining and cultivating existing client relationships takes on a whole new meaning. Obviously, this business could also go to a competing bank so that is the part that you have to focus on.

This does not mean you won’t have new business origination targets, but you would likely spend more time retaining your existing clients and aiming for a bigger wallet share. The amount of time you spend on relationship management or business origination depends on your seniority. Analysts and Associates aren’t really expected to sign on a new client but rather just work on whatever is assigned to them. But building client relationships is always valuable in banking.

Industry Relationships

Product & Sector Knowledge

Technical Skills

Deal Experience

4. How to get into DCM?

Your DCM Resume need not be much different from your standard investment banking one. You need to focus on your numeracy, analytical skills, modelling skills and attention to detail. However, your main focus should be on highlighting your knowledge and experience about fixed income securities because that is essentially the essence of what you would dealing in day in and day out.

Be sure to grab any internship opportunities during your college time to maximise your chance of getting an offer or further interview opportunities once you graduate. I covered more of this in the article on bank internships. The truth is that for a fresh graduate, such internship opportunities are perhaps one of the only ways to really showcase any practical experience in the field.

4.1. Academics

Dealing with fixed income securities required sound understanding of mathematical concepts and as such degrees focusing on these skills will be required. Business, finance, accounting, economics, mathematics, computer science and even physics and engineering are all acceptable.

What matter most is the reputation of your university and your academic performance. Bulge bracket investment banks only visit the so-called target universities. But non-target students still can and do make it with a combination of other factors.

Series 7, 63, 79 exams (or others) may be required in the United States. Please check the FINRA website for details.

4.2. Courses & Professional Certifications

Capital Markets can be a tough niche to break in. You really need to add some extra value to your CV to get a shortlist. The best way to go about doing that is getting some fixed income/ debt capital markets specific Professional Certifications on your CV.

These courses will provide you with several benefits:

- A working knowledge of the technical aspects of how capital markets actually work.

- An understanding of market instruments and derivatives.

- Will showcase your commitment to, and interest in, capital markets.

- If you successfully complete the course, you get a formal certification that you can add to your resume or LinkedIn profile. This is a rather solid branding opportunity.

- It will also give you an opportunity to steer the conversation towards what you learned in the course during an interview.

I have picked the best courses/ certifications that offer all of these benefits and ranked them in this article:

Best Fixed Income/ DCM/ Bonds Courses (2022) ranked by Bankers

4.3. CV Building

The hardest part of the selection process is having your CV short listed. You can crack the interviews and ace the tests, but first you need a shortlist. And each year, more and more candidates from across the globe are applying for each DCM opening. Its a tough nut to crack and you need some heavy hitting bullet points on your CV. I have handpicked some of the best resume wring services for finance and investment banking roles here:

Best Resume Writing & Review Services for Investment Banking & Finance ranked by Bankers

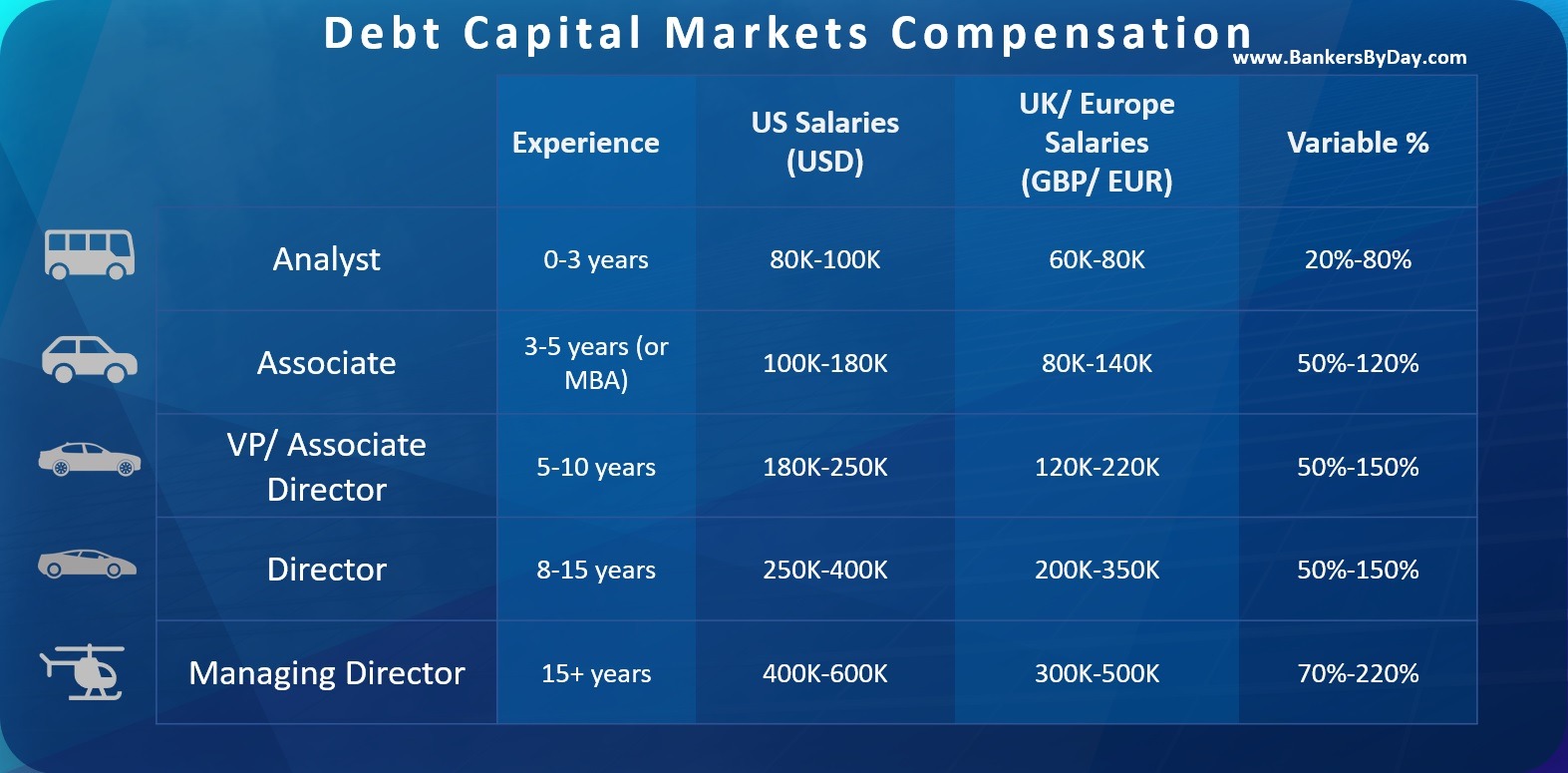

5. Salary and Bonus

Analysts salaries for a bulge bracket investment bank in New York would be around USD 100K. You should also expect a variable component over this but that is generally modest (around 50%) at the analyst level.

As an Associate, expect fixed compensation of around USD 150K with a 50% -120% variable component based on your performance and the group’s revenue generation as well. Across the pond in Europe, the salaries are almost comparable although slightly on the lower side outside of London.

Beyond the associate level, it becomes increasingly hard to predict the numbers as compensation begins to vary significantly based on a number of factors biggest of which is your actual performance. However, just keep in mind that compensation would be based upon how much revenue bring in for the bank and while DCM is a high-volume business, margins are usually tighter.

6. DCM vs M&A

Perhaps the most obvious difference between these two roles, at least to me, is the fact that you take on more responsibilities quicker in DCM. You start dealing with CXO level executives a lot sooner than you would in M&A.

Salaries – DCM salaries are more or less the same as that for M&A analysts at the Analyst and Associate level. As you go higher up though, variable compensation starts playing an increasingly bigger part and that depends on how much business you generate. M&A guys usually generate more and therefore the overall compensation is usually on the higher side for them.

Hours – In terms of hours though, DCM guys have an edge. The flow is more stable, and your activities are more structured. You deal with investment grade companies for the most part and in my experience that usually means less stress all around. As I progressed through my career, I realized that is an important consideration.

Exit Opportunities – Lastly, in terms of exit opportunities, M&A guys usually have an edge if you are looking to get into Private Equity and such because of their superior modelling experience and working on riskier and more dynamic companies than DCM people usually do. Still, it’s not impossible and there are plenty of other opportunities as well like Hedge Funds or moving into corporate finance.

7. DCM vs ECM

Despite appearances, there is not much in common between Debt and Equity Capital Markets when looking at it from an employment standpoint. DCM is all about large deals, high flow, low risk and simpler modelling. ECM deals are more complex, there is more uncertainty, and higher risk, but the deals are fewer as well. The global debt market dwarfs equity markets by a considerable margin.

Salaries are comparable and the hours are usually better for DCM. Variable component is usually higher for ECM and it also offers better exit opportunities. But the equities market is highly susceptible to global investor sentiment. There may be times when the deals dry up and it is not unheard of for banks to slash their ECM teams when this happens.

At the end of the day, it becomes a matter of personal preference. I personally loved dealing with fixed income securities because they are more predictable and stable than dealing with Equities which is like staring into a crystal ball. But don’t let my personal opinion affect yours.

8. DCM Work Hours

DCM hours are generally consistent and stable and a lot easier than what your M&A colleagues will have to endure. Much depends on the deal flow but generally speaking, the flow is predictable and smooth. The execution and issuance are also more standardized and structured so there is less hair-pulling involved. DCM analysts and associates usually come in between 8 and 8:30 AM and can usually afford to leave before 7 PM.

All of this translates to a healthier work-life balance and DCM hits the sweet spot when it comes to careers on the corporate finance side of things, in my opinion. I think a lot of the extras hours that some people put in is a result of them trying to “impress” their seniors more than anything else. In my opinion, that actually ends up doing the opposite since you come across as in-efficient and boring but it’s hard to break stereotypes.

9. DCM Career Path and Progression

DCM itself is considered a good long-term career option. Consider the sheer volume of the global debt market – there are opportunities in every country, both public sector and private, as well as every sector of the industry. What this means is that you would have plenty of opportunities to move from one bank to another or from one country to another based on your personal preference.

As a graduate, you start off as an analyst and make every effort possible to ensure that you get promoted to associate as quickly as possible. If you have a Master’s degree like an MBA, you would start at the associate level directly and eventually move up the ladder to an associate director, director and finally managing director.

The hours in DCM are good enough to afford you a decent work-life balance and the compensation is good enough even when compared with other investment banking opportunities. You spend more time with clients at the more senior levels and would likely end up heading the geography when you finally reach the managing director position. That is when you can really leave your mark and handle things the way you see fit. It’s undoubtedly a long journey to the top, but isn’t that what a career is all about?

9.1. Lateral movement

DCM clients are usually sophisticated, large corporations with experienced finance teams of their own. This means that your learning and impact is limited which translates to fewer exit options when compared with other investment banking teams.

This does not mean that exit options outside of DCM do not exist. Many analysts and associates move to corporate banking, coverage teams, leveraged finance, structured finance and so on. Moving to private equity can be a bit tricky but it’s not certainly unheard of. DCM is not the ideal place to start if you want to move to one of those roles, but with enough networking and skill building it is possible if you really try.

Another viable option for DCM experts is to move to fixed income or credit trading roles. This is usually possible at the lower levels when you have already built a good understanding of the technical aspects but have not yet straitjacketed it yourself into an advisory role.

Lastly, there is also the option of moving into a rating agency, assuming that a senior role is offered which can match your existing salary.