What is Trade Finance?

Trade Finance is the combination of products and services used by corporations to facilitate and finance international exports and imports of goods and services. Banks providing trade finance services act as intermediaries between buyers and sellers, ensuring timely payments and providing performance guarantees.

Trade finance essentially has two components to it:

- Firstly, the idea is to protect both the buyer and the seller who are unknown to each other or at least don’t trust each other enough when it comes to multi-billion dollar transactions.

- And secondly, the focus is on financing some of that trade by offering short term loans.

This is basically the essence of what a bank’s trade finance division does and it is an ideal career for those who are looking for international exposure and travel while at the same time earning a pretty decent salary without the burnout that is intrinsic to some other roles.

Job Description

Trade finance is a product division within corporate and commercial banking. What this means is that the trade finance guys are brought into the picture by the relationship management team if and when some sort of international or even domestic trade deal/ regular flow is expected. As you can imagine, for any large corporate client the trade finance team would have a lot of ongoing business due to the continuous import and export requirements of the company.

The main activities in trade finance may be bucketed into three main categories:

Securing Trade

This part of the job revolves around selling products that allows clients to export and import goods with the understanding that the banks in the middle will sort of act as guarantors for the trade transaction. This is done through products like Letters of Credit, Standby Letters of Credit etc. Essentially, the banks act as middlemen and ensure that their respective clients don’t get ripped off. The role of a trade specialist is to negotiate and sell these products to their clients.

To be honest, this part of the job is not really all that complex, but it does require a lot of transactional servicing. And in case of larger clients, you might be required to set up a unique process for dozens of countries with different laws and things tend to get a little crazy then.

Funding Trade

This is where the financing part of trade finance comes into the picture. Many medium or sometimes even larger companies often rely on banks to fund their imports or to advance them cash against payment commitments like Letters of Credit. This is also usually a transactional process where most of the work is actually done at the time of deal initiation. In fact, because of this transactional nature of trade finance, many banks often include trade finance under the transaction banking division or global transaction services or something of that nature.

Structuring Bespoke Trade Deals

This is where things get really interesting. Structured Trade Finance is the term used to define bespoke and more complex trade transactions. Such deals require complex coordination and input from various other teams as well. Such a deal might involve creating special structures and integrating various products from FX to vanilla loans to create a custom trade solution for the client.

Supply Chain Finance is a more specialised subset of trade finance which is used in more specific cases as described in the linked article.

Qualifications and Skills

One unique aspect of trade finance is that unlike many other banking roles, there is less of a focus on financial analysis and modelling and more on regulatory and legal aspects. This makes it a unique career for those who do not wish to spend a lot of their early years grappling with Microsoft Excel but would rather spend that time learning about trade regulations and policies.

Quantitative skills are still required for complex transactions which may require something like multi-currency hedging or interest rate arbitrage, but such things take a lot less of your time when compared with other banking roles.

Knowing the rules and guidelines – There are a whole bunch of rules and processes put in place by multilateral trade organizations like the International Chamber of Commerce, World Trade Organization etc. One such set of basic guidelines that trade finance managers must learn is the Uniform Customs and Practice for Documentary Credits which has been explained in this presentation by Citi. It might help in case you want to whet your appetite with respect to trade. This is by no means the only set of guidelines though.

Product knowledge and the ability to gain the client’s trust – Trade products are not super complex themselves, but all the different rules and multiple legal jurisdictions can sometimes make things tricky even for experienced bankers. Knowing what products would be best suited for a particular trade deal can go a long way in building a good rapport with the client. Even some of the larger companies rely on their bankers to advise them on the specifics of international trade transactions and the trade team probably gets the most face time with the client after the coverage/ relationship teams.

Country specific laws – Next, we have the country specific laws which means complying with the rules of all the countries that the trade transaction is going to touch. Normally, there is nothing too complicated here but there are certain VERY strict exceptions that must be adhered to. I am referring of course to international sanctions. Banks have been fined hundreds of millions of dollars and even risk losing their licenses over such sanction breaches. The trade finance team does have support from their back-office teams but at the end of the day, they are the experts who have to ensure full compliance for each and every international transaction that they execute for their clients.

Being a good salesman– Trade finance is a transactional flow business which means that once you start, you keep getting a continuous flow of business as the client will keep importing and exporting as part of his ongoing operational requirements. This can make trade finance a rather profitable service to offer and indeed for many banks it does form a significant chunk of their overall income. Competition is stiff in trade finance though as all the banks are vying for what is essentially a continuous stream of revenue.

Crisis management – Being a relatively high-volume business, it is not uncommon for some trade deals to get stuck because of some sort of documentary deficiency every once in a while. In such cases, shipments can get delayed and cause significant losses for every hour that they are not moving. The ability to manage different stakeholders in such situations and figuring a way out can prove immensely valuable.

How to get into Trade Finance?

A trade finance role falls somewhere between a coverage/ relationship management role and a very specialized product role. Therefore, you need to showcase aspects of client engagement as well as product knowledge.

Client Engagement – Any front-end experience like sales or relationship management would really help your case for trade finance. The trade teams spend more of their time engaging with clients than they do at the office.

Product Knowledge – We have already covered the type of knowledge that you need in the section on skill requirements. The truth is that the bulk of such knowledge can only be gained while on the job. But the good news is that it is not overly complex. Unlike many other banking roles in corporate finance or investment banking, you need to be stronger at the legal and regulatory aspects rather than having mathematical or quant-heavy skills.

Academics and Certifications

In terms of academic qualifications, a business or law degree would work well although an MBA would obviously be best suited for this role. You can get in even with a quant heavy degree like accounting, physics, finance or engineering but as I have already mentioned, quant skills are not very critical for this role. Its more about having the product and regulatory knowledge and the ability to manage clients.

Online Courses & Certifications

There are a number of universities offering online courses in trade finance and management. The challenge with trade finance lies in the fact that the laws and practices can differ significantly between countries and you have to have a basic idea about all of them.

That being said, many of the foundational concepts are common and they are explored in these courses and certifications. Here are the best ones for Trade Finance:

Best Trade Finance Certifications/ Courses (2022) ranked by Bankers

Resume Building for Trade Finance

You need to highlight any relevant experience in trade finance to get the more coveted roles. Entry level roles will be easier to get into. Focus on International business aspects and it might be worth it to look into a few of the courses and certifications that have been linked to in the previous section.

If you still need help with your CV, the following professional services will help you polish it or even work on it from scratch:

Best Resume Writing & Review Services for Investment Banking & Finance ranked by Bankers

Salary and Bonus

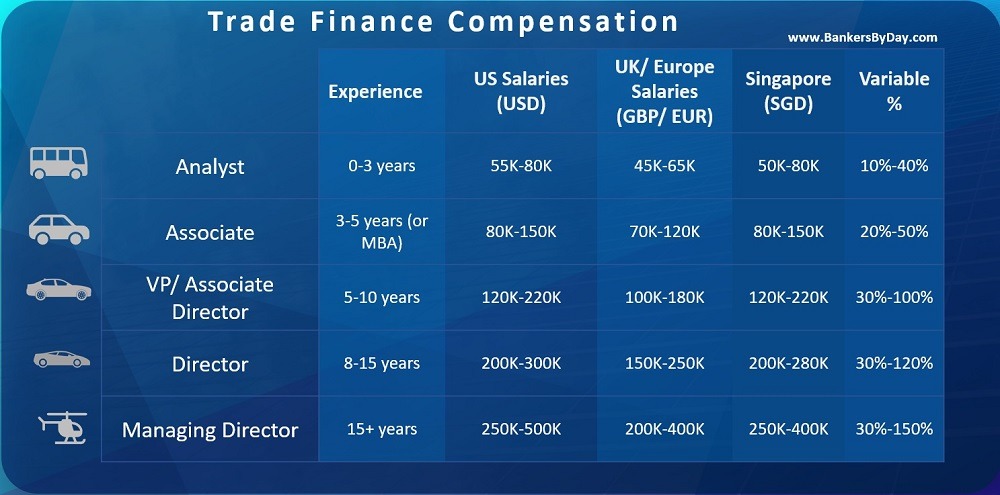

Trade finance professionals at the associate level can expect to earn anything from USD 75K to USD 140K (plus a variable component) depending on location and the bank they are working for. Salaries in Europe are similar at around EUR 60K to EUR 120K for an associate level position and SGD 70K to 120K in Singapore.

This could also vary based on which client segment you are covering. Keep in mind that these are salaries for the front-end staff and not for the back-end or trade operations teams. For mid-level positions, you can expect to earn USD 250K with some banks.

In terms of variable pay, it totally depends on your annual performance appraisal. But since this is a revenue generating business unit, you can expect pretty solid numbers if you manage to hit your revenue and other targets. It is fair to expect a minimum variable component of 20% and going up to 60%-80% for the high performers. Most people will likely fall somewhere within that range.

A Normal Day in Trade Finance

Trade finance managers spend some of their time ensuring that the usual flow of client transactions does not get disrupted. A good chunk of the transaction process is obviously automated and there is a back-end operations team which actually handles the operations, but the trade finance specialist might have to intervene to handle any exceptions or when something “breaks” (and things do tend to break from time to time).

The trade finance specialist is also responsible for communicating with the client and troubleshooting on their behalf. Since we are talking about corporate banking, the transaction size is usually large enough for even small delays to be of concern to the client. In such cases, it is the trade finance manager who gets the call (only for trade related transactions). So, the job becomes one of managing the client while at the same time clearing the bottlenecks internally. Often times, this could even mean making some exceptions and seeking approvals for such exceptions.

Expanding the bank’s trade business is the third major task. This might involve on-boarding new clients or trying to get a bigger share of the pie from existing clients. Depending on the nature of your clients, a lot of international travel might be expected. For example, if you are structuring a complex deal which involves some imports from Brazil or Indonesia for your client in Germany, it usually involves coordinating with your regional teams, getting inputs from the local legal and trade experts and even some meetings with the exporters and their bankers.

Work Hours

Hours in trade finance are usually very agreeable. You start at around 9 AM and are usually done by 6 PM. That is not to say there aren’t high stress days. If there is an important client transition stuck, or if you are working on a huge new business opportunity, you can expect to burn the midnight oil and spend 14+ hours at the office. Such days are few and far between though and the culture in trade finance is usually focused more towards balance and stability rather than spurts of growth.

While the hours are decent, the international nature of trade finance does mean that you might have to schedule calls with counterparties, clients or colleagues on the other side of the globe at odd hours. This is not much of a problem if you are in Europe as you straddle the time zones between the US and Asia.

Trade Finance in Asia

New York, London, Chicago are your typical global financial hubs but when it comes to Trade Finance, Asian cities are heavy hitters as well. India, ASEAN and China offer great opportunities for Trade Finance professionals offering diverse career opportunities.

Singapore

Singapore is a major hub for Trade Finance due to its strategic location and robust financial services sector. The city employs thousands of Trade Finance professionals in sales, product, structuring, compliance and operations roles (the product team is the one that designs specific product offerings).

If you are working in Trade Finance, you are likely to have some sort of association with Singapore. Kuala Lumpur is also a good option with a number of Trade Finance jobs available at any given time.

India and China

The two Asian giants are major players in global trade. Hong Kong, Shanghai and Mumbai are the major hubs but given the sheer size of these countries, some Trade Finance activities get spread out to other cities as well (especially port cities next to major industrial hubs).

Raw material is imported from countries like Indonesia, Australia, Brazil etc. and finished goods are shipped out to Europe, North America and elsewhere. All of this trade requires funding and performance guarantees and that makes these countries highly profitable Trade Finance hubs with plenty of career options.

Career Path and Progression

Trade Finance is generally a big enough vertical in its own right to offer good career growth prospects. It is entirely possible to move in and out of various corporate banking roles, but if you really are a specialist in your field, you would be better served by sticking to what you know.

Organic Growth

The first career path is to keep progressing along the chain in the same vertical. As you get more experience, you can get more important/ bigger clients and increase the revenue you bring home for the bank. This will eventually reflect in your own compensation and if you are good, you can expect generous salary increments and hefty bonuses. Eventually, you would begin handling teams of other trade finance specialists and have the potential to keep rising to regional, country or global trade head positions.

Natural growth in trade finance is rather easy since the requirement for product and regulatory knowledge creates a natural entry barrier for outsiders.

Moving up the value chain

The second career path is to move from segment to segment. Many trade finance specialists start by handling the SME segment of clients where the product suite is limited and so is the client revenue. As you gain experience, you can move to the bigger client segments which requires a broader product and regulatory understanding as well.

When you start handling the really big Global Fortune 100 type clients, that is where things get most interesting. Given the sheer volume of transactions, the revenue potential increases even though the margins get squeezed. And you know how it goes in banking – the more revenue you bring in, the more you get paid. Deals also get more complex, requiring structured bespoke solutions with lots of opportunities to cross sell currency derivatives, swaps or dozens of other products.

Corporate jobs

Large international companies (your clients essentially) also have trade teams of their own that help them with exports and imports. Given your vast experience with international trade, you generally become a high value recruitment target for them and it might make sense to switch over if you are looking for change and some of those companies can definitely afford to make a more than generous offer. The best part is that you usually get to join at a higher position when compared with someone without that kind of experience.

International Opportunities

Another great thing about trade finance is that it allows a lot of great opportunities for working overseas. Trade finance specialists interact a lot with their counterparts in other countries and build up a reputation for themselves not just locally but overseas as well. Over time, they also build up a lot of knowledge about other countries’ trade and regulatory laws. What this means is that trade professionals have a wider opportunity to tap into any senior level positions that open up globally. For example, let’s say you are working in the UK and a new position opens up for heading the entire SE Asia division where you could be managing 10 countries – that might be a good opportunity to get a promotion while spending some time in Singapore or Malaysia!