Investment banking continues to be one of the most most rewarding and well paid careers out there. A lot has changed in the last decade, with AI and tech changing the game. But what that really means is that the focus has shifted from quantity to quality when it comes to investment banking.

In fact, investment banking has become even harder to break into because banks are looking at fewer but better trained professionals. There are thousands of candidates applying for every single role and you need every advantage you can get.

Academics, soft skills, networking etc. all play into it. But what IB specific courses should you take to best prepare yourself for the selection process?

I have handpicked these courses after completing most of them and assessing their quality, brand value and relevance for IB. These should help you get the edge. But remember, you still have to put in the work.

1. Wall Street Prep’s Premium Package

Who is it for?

Future investment banking analysts.

Course Review

What better way to learn about investment banking than a course that actual investment banks use to train their fresh hires? That is what Wall Street Prep’s Premium Package offers to it’s corporate clients and that is what they are offering here to anyone who wants to make the effort of learning the ins and out of investment banking. And when it comes to investment banking, that extra effort is always worth it.

Wall Street Prep has been a well known provider of financial training for investment bankers for decades now. Back when I was just a starry eyed boy in business school almost 15 years ago, WSP was still one of the better course providers out there and they have only built on that reputation since. Now, they teach that program at top investment banks to get fresh hires up to speed and also at some of the world’s top universities. You have access to the exact same program and you can use that to get ahead and stand out. The corporate world is all about personal branding.

I have been on both sides of the interview table and we get thousands of resumes for every single job opening. You need something to make it through the first round of screening before the CV even filters its way across the HR’s desk. What makes a certification valuable and worth perusing is how easy it makes it for the company to shortlist you because they know you possess the technical skills required for the job. And that is what this certification offers. Its instantly recognizable in the industry and that is what it gives you an edge.

In terms of content, I have gone through most of the videos and what I liked most was that it focuses on what you actually do on the job rather than just academic theory. Which obviously makes sense because the courses have been designed to help investment banks train their analysts so they can hit the ground running.

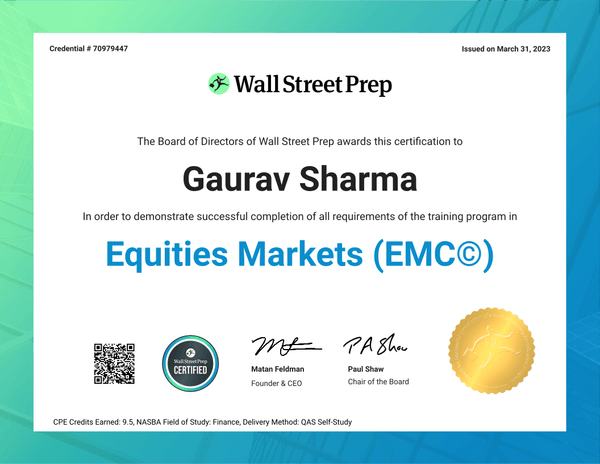

You get a nice certificate that you can embed to your LinkedIn profile or anywhere else

I won’t go over the entire table of contents as you can just look it over using the link below, but suffice to say it covers most of the important IB stuff in adequate detail. Financial statement modelling, DCF, M&A, trading comps, transaction comps, LBO etc., its all in here. Most academic courses are very light on comps and I really like the focus on that here because its actually the biggest factor in my experience.

You have to complete a test at the end of the program to earn the certification and then you can use it build your personal brand, make your CV stand out and add it to your LinkedIn profile. In summary, this is a good practical course with solid industry recognition that ticks all the right boxes.

Click here and use code BANKERS for a 15% discount on this course!

Summary

| Duration | Around 35-45 hours |

| Format | Fully online, on-demand |

| Level | Intermediate |

2. Certified Financial Modeling & Valuation Analyst (FMVA)

Who is it for?

Most versatile certification suitable for all investment banking and finance roles. May be customized as per your requirements.

Course Review

I have completed several FMVA courses and I think its one of the better ones out there in terms of quality and presentation. That might seem like a low priority, but believe me when you are tired and don’t feel like studying, this is what really helps you go that extra mile. And that is what really matters in this industry. Just going that extra mile when everyone else has already rolled over.

What I like most about the highly popular FMVA certification from CFI is that you can use it for almost any role within investment banking. Early on in your career, you might not want to straitjacket yourself into focusing specifically on a very niche role like M&A, debt capital markets, coverage etc. but simply want to get in. The FMVA is what you need for that as it can be whatever you want it to be because it has elective courses that you can use to tailor it to your needs.

For example, if you are interested in M&A, you can pick the M&A elective. But if you are interested in Commercial Real Estate, you can pick the Real Estate Financial Modeling elective. Other such options include LBO modeling, mining, renewable energy, startup or eCommerce modeling and so on. So you get to pick and choose and get what you want from it.

This can be quite an advantage in a tight job market when you can’t afford to go after just one specific IB role. The FMVA is inherently versatile and it is that versatility that makes it highly appealing for investment banking hopefuls and even for corporate finance roles.

The Corporate Finance Institute is well known in the finance community and the FMVA is their flagship certification. So you would be adding significant brand value to your CV and LinkedIn profile with this certification. Of course your academics still matter the most, but such certifications are your best at getting that extra boost in a highly saturated job market.

Click here and use code BBD10 for 10% off on this course!

Summary

| Duration | 100-150 hours |

| Format | Fully online, on-demand |

| Level | Intermediate |

3. The Investment Banker from Financial Edge

(Note: Use code BBD25 for 25% off at Financial Edge)

Course Review

My first year in banking, I had to complete a lot of training programs. These are training programs that cover specific aspects of your job and help you hit the ground running. Back in the early days, you were just dropped into the bullpen and expected to fend for yourself. But these days you have a lot of orientation and onboarding programs and a lot of mentoring and training. Financial Edge is one of the companies that provide this training. And they are one of the best ones out there – the preferred choice of several top investment banks.

So when I found out that Financial Edge have started to offer that very same program in an online format that literally anyone, anywhere in the world can participate in, I knew I had to check it out. And it certainly did not disappoint. This is a certification program that has a lot of weight behind it. In fact, because many banks use this program themselves, it’s very likely to help you get your foot in the door. That is what IB recruitment is all about. Building your personal brand, building your story and showcasing that you have the necessary skills at a level that is congruent with the requirements of the job.

In terms of curriculum, you have almost everything needed to hit the ground running. Modules on financial statement analysis, modelling, valuation, M&A and even interview tips are there to help you prep for the selection process. There’s no point in listing the whole curriculum as you can check it out using the link below but suffice to say it covers almost everything that I could think of. There could probably be a bit more on capital markets but those are more specialized roles within investment banking.

The content quality and deliver are excellent. The instructors and course designers and industry pros with real world expertise and they know that you need real world insight more than academic theory. There are over 250 practical exercises which I think are more than enough to get the point across. Successful completion is necessary to get the formal certificate but it’s definitely worth it. Use it to spruce up your CV and LinkedIn profile and get notices.

Click here and use code BBD25 for a 25% discount on all Financial Edge courses!

Summary

| Duration | Around 45 hours |

| Format | Fully online, on-demand |

| Level | Intermediate |

4. Investment Banking Certification from NYIF

Who is it for?

Graduates or finance interns interested in breaking into IB. Professionals in other verticals looking to make a switch to IB.

Course Review

- Investment banking is notoriously hard to get into and you need every edge you can get. This formal Investment Banking Certification from one of the stalwarts of Wall Street training is one way to get that edge. There are other finance courses out there, but this one is laser focused on Investment banking and that is what makes it the ideal pick for most.

- This is a self-paced, fully online program offered by the New York Institute of Finance that offers the most comprehensive look at Investment Banking for interns, analysts and associate level roles. It takes about 70 hours to complete, depending on your skill level. This means you don’t have to wait around for years to earn a certification. You need these certifications at the beginning of your career, not 4-5 years later! This is a strong point in favour of this certification.

- The course covers all relevant topics ranging form modeling and analysis to derivatives, valuations, structuring and deal making. Which makes this well suited for professionals looking to get into all Investment Banking roles. You also get to choose a specialization that allows you to better prepare for specific roles.

- In addition to showcasing your skills, this certification will also showcase your commitment to the field of Investment Banking as it is specifically focused on it. As a recruiter, you want to know if the candidate is actually interested in a long term career or not. The firm spends considerable capital and time training their recruits and taking the time to earn a formal certification showcases to them that you are just as committed.

Summary

| Duration | 60-70 hours |

| Format | Fully online, on-demand |

| Level | Intermediate |

5. Executive Finance Programme from Saïd Business School, University of Oxford

Who is it for?

Business leaders, managers, senior non-finance executives, consultants and others interested in learning more about M&As, IPOs and other investment banking activities.

Course Review

This is a unique course in the sense that it covers the basics of caproate finance, but from the perspective of a senior executive. You will still learn about things like time value of money, IRRs, NPVs, cost of capital CPAM etc., but the focus is on how to use these for strategic level decision making. That is what makes this offering unique and earns it a top spot on this list.

Oxford is indeed one of the best universities to have on your CV and the personal branding opportunities here are immense. If you are trying to up your finance credentials and are involved in, or hope to get involved in M&A, IPOs, debt issuance or other investment banking actives from the perspective of a corporate, then this is an excellent investment of your time.

M&As and IPOs are hard to get right even for the most seasoned executives. They are monumental undertakings and not everything about them can be taught in the traditional sense. But this course utilizes real world insights to deconstruct the processes, problems and value of these financial actions.

Interestingly, ESGs (Environmental, Social and Governance) considerations get a chapter all of their own which is always good to see. These are super important from the perspective of a senior manager and older courses generally skip on these. However, these can make or break a deal and I have seen many mergers fail due to governance or cultural issues. Good to see these front and center.

Click here and use code GS-AF-BBD15 for a 15% discount on this course!

Summary

| Duration | 6 weeks, about 8 hours a week |

| Format | Fully online, on-demand |

| Level | Executive |

6. Private Markets Investments Programme from Saïd Business School, University of Oxford

Who is it for?

Mid-level investment bankers, fund managers, analysts, traders, or other finance professionals looking to enter these fields.

Course Review

This is an executive level program is designed for mid or senior level executives who want to learn about private markets. It’s not really as quantitative as some of the other programs on this list, but at this stage in one’s careers, the focus changes from number crunching to strategic level analysis anyway. And that is what this course excels at.

You start off with an introduction into the structure of the private market and how it all works. This also includes valuation methodology, financial modeling, capital structure and other components of a private market asset acquisition or sale. Then you move on to structing of investment vehicles which is a massive topic on its own followed by performance evaluation and future trends.

There has been a definitive trend towards private markets which is why it is important to learn how this segment works in addition to the public markets.

Click here and use code GS-AF-BBD15 for a 15% discount on this course!

Summary

| Duration | 6 weeks, about 8 hours a week |

| Format | Fully online, on-demand |

| Level | Executive |

7. Mergers & Acquisitions Professional Certificate from NYIF

Who is it for?

Serious M&A candidates including B-School graduates, interns and those looking to make a lateral shift into M&A.

Course Review

M&A is one of the hardest fields to break into in Investment Banking and you need every edge you can get. This certification provides a healthy mix of academic insight, real world practical knowledge and some solid CV building opportunities.

If you are applying for an M&A role, you are probably already familiar with the main academic concepts. This course provides more in the way of actual deal making insights, transactional due diligence and other considerations that come into play in a live deal. Documentation, legal issues, tax considerations and other such topics are covered in great detail. These will give you a bit of an extra edge during the selection/ interview process.

You receive a formal certificate from NYIF upon completion. NYIF has been providing financial education to bankers for almost a century. So this certification will have an impact on your CV or LinkedIn profile. With recruiters having to sift through hundreds of CVs for a single role, you need something that makes you stand out.

Summary:

| Duration | 40 hours/ 5 days |

| Format | Fully Online or Classroom |

| Level | Advanced |

8. Professional Certificate in Corporate Finance from Columbia

Who is it for?

Corporate finance roles and those looking to add a solid brand to their CVs.

Course Review

Columbia University is a great brand to have on your Resume. This is the same course that is taught in the first year for Columbia’s core MBA program so you know you are learning what the pros are learning. I wish we had online learning opportunities like this back in our day!

The introduction focuses on basic corp fin concepts like time value of money, capital budgeting, NPC and IRR etc. Then you get a good look at how bonds, stocks and companies are valued using free cash flows, ratios and multiples. Lastly, there is a section on risk, return, cost of capital and a case study. This course covers the basics but it does that really well.

The quality of the content is excellent and you know this is a course made by the people at the top of their field. Its an experience feel almost everyone in finance should go through once, irrespective of your preferred role. This is corporate finance 101.

Summary

| Duration | 35-40 hours |

| Format | Fully online, on-demand |

| Level | Intermediate |

9. Professional Certificate in Valuation from NYIF

Who is it for?

Investment Bankers, researchers, equity and bond analysts who need to learn advanced valuation techniques.

Course Review

You can’t sell something unless you know what it’s worth. In investment banking, pricing and valuing assets is the name of the game. M&A bankers try to price business divisions or entire corporations, capital market bankers try to figure out how to price equities or bonds which also involves figuring out the value of a business. Eventually, it all boils down to corporate valuations and this is the best course to teach you that.

You can tell this course was made for investment bankers as there are specific sections on equities, fixed income, derivatives, corporate credit analysis, business valuations, financial statement analysis, and even M&A considerations like financing acquisitions, managing their risk and even post-merger integration.

The course itself is of high quality and is delivered by industry experts. You get a professional certificate from NYIF on completion which you should use for min-maxing your CV for investment banking roles.

Summary

| Duration | 45 hours |

| Format | Fully online, on-demand |

| Level | Advanced |

10. Capital Markets & Securities Analyst from CFI

Who is it for?

Anyone interested in a markets/ securities role like traders, financial markets, institutional sales, FICC, structuring, asset and portfolio management, wealth management etc.

Course Review

The Corporate Finance Institute (CFI) offers a few key finance certifications and the Capital Markets & Securities Analyst (CMSA) is their answer for all market related roles. It is relevant for anyone in markets related role like securities sales, trading, analysis, market risk, portfolio management, asset management, private banking, and so on.

The best part is that you don’t have to spend several years to complete it. It takes about 60-100 hours of effort which means you can complete the whole thing in a few months and get your designation when you need it the most – at the very beginning of your career.

One thing I really do love about CFI courses is that they are highly modular in nature. For example, if you are a beginner you can opt to take some of the optional prep courses like Bloomberg Essentials, Economics for Capital Markets or Financial Math for Capital Math. but you can skip them altogether if you already this stuff.

Similarly, there are a bunch of electives that you can pick to tailor the course to your specifications. You can pick Technical Analysis if you so choose or perhaps you are more interested in Convertible Bonds, Behavioural Finance or Subordinated Debt? Pick and choose what you want and focus on the stuff that is relevant to you.

Click here and use code BBD10 for 10% off!

Summary

| Duration | 60-100 hours |

| Format | Fully online, on-demand |

| Level | Intermediate |

11. Capital Markets Professional Certificate from NYIF

Who is it for?

Debt and Equity Capital market roles (DCM/ ECM). Suitable for all skill levels.

Course Review

This course, also offered by the New York Institute of Finance, focuses more on capital markets (debt and equity). This certification is better suited for DCM/ ECM professionals as well those in trading or research roles related to debt, equity and their derivatives

Most finance courses go broad which means you spend a lot of time learning things that might not be relevant to you. By being laser focused on just capital markets, this course offers unsurpassed value to those who are also laser focused on capital market career options form the get-go.

I couldn’t find any other course that covers all relevant capital market topics with this much detail and with such quality. This is not just another generic finance course. This is what DCM/ ECM guys should be studying.

Summary

| Duration | 35 hours |

| Format | Fully online, on-demand |

| Level | Intermediate |

What to look for in an Investment Banking Course/ Certification?

- Brand Value for CV Building – Research suggests that recruiters spend on average just 7 seconds to glance at your CV and that is all the time you have to make an impression. Your academic pedigree and work experience matters here the most, but you can’t change that. What you can do though is add relevant certifications that showcase your interest in the field and demonstrate a minimum level of capability.

- Specific to your Role – There are dozens of certifications out there, but not all of them are relevant to the role you are interested in. Some are suited for risk managers (FRM), others for traders (like the CFA) etc. This is the list of the ones that are relevant to investment bankers – meaning M&A, financial modeling, Debt & Equity Capital Markets, coverage and so on. Read my summary below to find one suited to what you are interested in.

- Available at the very start of your career – Certifications like the CFA & FRM are indeed prestigious but they require several years to complete and a lot of prior work experience. I cleared the CFA and FRM Level 1 exams within two weeks of each other while in B-School but it wasn’t really helpful because it would be YEARS before I would earn the certifications. You need something NOW, not 2-4 years in the future.